08/05/2009

Bankers’ state of mind between lines: Switzerland v. Luxembourg

Le secret bancaire helvétique existera tant que les Suisses le soutiendront. Ce qui est différent, c’est qu’il ne sera plus possible de se réfugier derrière le secret bancaire pour les activités réalisées avec la clientèle à l’étranger. On ne pourra plus faciliter l’évasion fiscale en s’appuyant sur le secret bancaire. (free translation : The Swiss bank secrecy will exist as long as the Swiss will support it. What is different, is that it will not be possible anymore to take refuge behind banking secrecy for the activities carried out with foreign clients. One will not be able to facilitate tax evasion anymore using banking secrecy) (Oswald Grübel, CEO, UBS today in le Temps)

He is said to have sent an e-mail to the staff to call for the strict respect of laws and regulations to enhance the good reputation of the bank. "Aucun écart ne sera toléré" (free translation : “No variation will be tolerated”), he wrote.

At the same time in Luxembourg:

« L’échange d’information sur demande fera qu’un contribuable étranger, soupconné de fraude fiscale grâce à des faits ou documents probants, pourra faire l’objet d’une enquête par son fisc national » (free translation: “the exchange of information upon request results in that a foreign taxpayer, suspected of tax fraud based on documentary evidence, can be investigated by his national tax department)

(Jean Meyer, Chairman ABBL, in the Lëtzebuerger Wort)

In Switzerland there is a commitment that states: “One will not be able to facilitate tax evasion any more” whereas in Luxembourg it will depend on evidence provided by the foreign tax administration.

Above all, in Switzerland they use the term “tax evasion” whereas in Luxembourg they use “tax fraud”.

This is confirmed by the recent ABBL press release that states against the study made for the “Cercle de cooperation”, : “Without making any noticeable distinction, the document in question assimilates very diverse issues such as tax fraud, tax competition, Money laundering, the problematic of North-South relations and intra-European discussions on the taxation of savings”

Why “tax evasion” is not quoted by the ABBL?

Tax evasion will remain in Luxembourg as many actors consider it is practically part of tax competition.

17:15 Posted in Comparison | Permalink | Comments (0)

08/04/2009

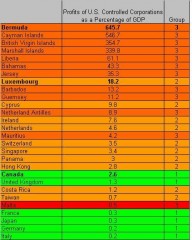

Tax Havens: International Tax Avoidance: the figures

Comment:

1. Median: 4.4

2. Canada is leader of the "G7" group

3. Luxembourg is leader of the "Larger Countries (GDP At Least $10 billion) on Tax Haven Lists and the Netherlands" group

4. Bermuda is leader of the "Small Countries on Tax Haven Lists" group

5. Luxembourg 8th jurisdiction every category (See list of US companies in Luxembourg)

6. All the jurisdictions before Luxembourg are small countries on tax haven lists

7. There are 5 jurisdictions after Luxembourg that are small countries on tax haven lists

8. The first jurisdiction of the G7 group (Canada) is 20th.

Luxembourg Prime Minister is quoted in the report page 10: "Luxembourg Prime Minister Jean-Claude Junker urged other EU member states to challenge the United States for tax havens in Delaware, Nevada, and Wyoming"

His name is misspelled like the word that means “something (as an automobile) of such age and condition as to be ready for scrapping (See Junker in the dictionary)

Is it a the work of the unconscious?

Jean Claude Juncker is the oldest active political governmental leader in the European Union.

He did not see the hurricane on tax havens coming.

It is very interesting to read again all of Juncker’s annual speeches before the parliament. In particular the one he gave last year whereas the text of the Levin, Coleman and Obama bill was known and that the Liechtenstein scandal took place. In 2008, Angel Gurria stated that "Excessive bank secrecy rules and a failure to exchange information on foreign tax evaders are relics of a different time and have no role to play in the relations between democratic societies"

In 2008, Jean-Claude Juncker

- did not speak about the problems of banking secrecy ("secret" : word missing)

- did not speak about the problems of tax evasion ("évasion" : word missing)

- did not speak about the problems of tax haven ("paradis" : word missing)

- did not speak about the abuses the offshore ("offshore" : word missing, "domiciliation" : word missing)

- did not speak about fraud ("fraud" : word missing)

-…

The former years he had spoken about these issues but definitely ignored their acuity in 2008.

In a nutshell, he did not see or did not want to see that he was up against the wind that now is blowing in his face.

He is once again Prime Minister after the General Elections. On 29 July 2009, the new government published the official version of its programme for the period 2009 - 2014. As far as the financial centre is concerned, the government foresees the following priority initiatives (Source: LFF):

- Pro-active support policy for the development of the financial centre as a main pillar of the Luxembourg economy.

- Strengthening of the international orientation of the financial centre. In European negotiations, the Government will ensure that all obstacles to an efficient working of the internal market shall be removed.

- Besides contributing to the development of the international activities linked to wealth management and investment funds, the government intends to diversify the activities of the financial centre (micro-finance, SRI, Islamic finance, philanthropy as a corollary to private banking).

- Geographical diversification of the financial centre. Besides the traditional European markets, the government will attract new investors from other regions, by making the centre better known in, amongst others, the Americas, Asia and the Gulf countries. The network of double tax treaties shall also be extended to the countries of origin of new potential investors.

- In order to ensure the legal security of new financial products, the government will accompany them with an appropriate legal framework. Particular attention will be paid to investor protection. The Government will closely monitor legal developments in other countries in order to safeguard the competitiveness of the Luxembourg financial sector.

- The Government places great importance on the professional supervision of the financial sector and will actively contribute to international and European developments in the matter. With a mind to prevent risks, the government will encourage cooperation and exchange of information mechanisms amongst competent national and European actors

There is nothing to correct the abuses that create the “tax haven”:

- There is nothing about strengthening supervision and sanctions.

- There is nothing about sanitizing the judicial and regulatory haven.

- There is nothing about revising and correcting the transposition of directives17:20 Posted in Comparison | Permalink | Comments (0)

08/03/2009

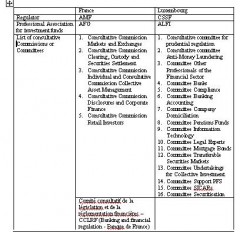

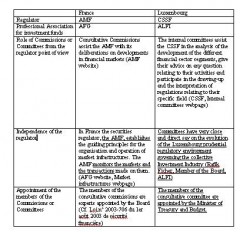

Regulators: France v. Luxembourg

In the context of the debate on the depositary, let’s compare the regulators in France and in Luxembourg on a couple of telling criteria.

Comment

There are much more committees/commissions in Luxembourg than in France but none for the clients. The members of these Committees represent the companies subject to the prudential supervision of the CSSF, professional associations representing the various segments of the financial sector as well as external auditors and legal advisers active in the financial field. Clients are not represented in the numerous committees in Luxembourg whereas clients are represented in the retail Investors Commission in France.

The internal committees in Luxembourg are tailored for the financial sector to have very close and direct say on the evolution of the Luxembourg prudential regulatory environment. The regulation in Luxembourg is practically subordinate to professionals in the framework of the numerous committees whereas in France the regulator, establishes the guiding principles for the organisation and operation of market infrastructures and monitors the markets and the transactions made on them.

Sources:

France

AMF : Consultative Commissions and Specialised Commissions

AFG: Relationships with the regulator

Luxembourg

CSSF: Consultative committees

ALFI : Relationships with the regulator

08:51 Posted in Comparison | Permalink | Comments (0)