08/03/2009

Regulators: France v. Luxembourg

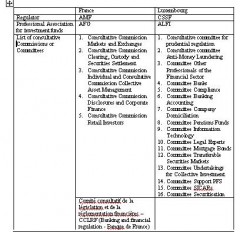

In the context of the debate on the depositary, let’s compare the regulators in France and in Luxembourg on a couple of telling criteria.

Comment

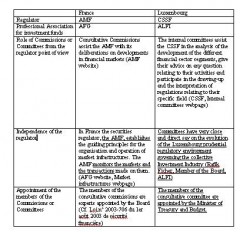

There are much more committees/commissions in Luxembourg than in France but none for the clients. The members of these Committees represent the companies subject to the prudential supervision of the CSSF, professional associations representing the various segments of the financial sector as well as external auditors and legal advisers active in the financial field. Clients are not represented in the numerous committees in Luxembourg whereas clients are represented in the retail Investors Commission in France.

The internal committees in Luxembourg are tailored for the financial sector to have very close and direct say on the evolution of the Luxembourg prudential regulatory environment. The regulation in Luxembourg is practically subordinate to professionals in the framework of the numerous committees whereas in France the regulator, establishes the guiding principles for the organisation and operation of market infrastructures and monitors the markets and the transactions made on them.

Sources:

France

AMF : Consultative Commissions and Specialised Commissions

AFG: Relationships with the regulator

Luxembourg

CSSF: Consultative committees

ALFI : Relationships with the regulator

08:51 Posted in Comparison | Permalink | Comments (0)

The comments are closed.