03/18/2009

FIU Luxembourg v. FIU Monaco

The annual report 2007 of SICFIN, the Monaco FIU, informs of the staffing of SICFIN and of its positioning:

Le SICCFIN, est un service administratif relevant du Département des Finances et de l’Economie qui répond à la définition internationale des Cellules de Renseignements Financiers. Le service est composé de 9 agents, spécialement commissionnés et assermentés. Le personnel du SICCFIN possède un profil bancaire et financier, complété par des connaissances juridiques, avec, pour certain, une spécialisation en audit et en contrôle. Ces compétences sont également complétées par des stages auprès d’autres CRF, notamment CTIF-CFT. A ce titre, des échanges réguliers ont lieu avec TRACFIN ainsi qu’avec la Commission Bancaire française afin de confronter les expériences de chacun en matière de lutte contre le blanchiment de capitaux et le financement du terrorisme.

Depuis 2005, le SICCFIN est doté d’un nouveau système informatique développé afin de répondre aux besoins nés de l’évolution de son activité.

There are 9 people with a banking and financial profile.

It is like most FIUs an administrative body under the responsibility of the Ministry of Finance.

The annual report 2007 of the CRF, the Luxembourg FIU, informs of the staffing of the CRF and of its positioning:

La structure de la CRF est demeurée identique à celle existante pour l’exercice précédent, à savoir qu’elle est composée de deux magistrats à plein temps, d’un magistrat à mi temps, d’un analyste financier et d’une secrétaire. Les activités de la CRF se déroulent sous la direction du Procureur d’Etat Robert BIEVER et du Procureur d’Etat Adjoint Jean-Paul FRISING. La CRF est épaulée dans ses devoirs de renseignement financier par un membre de la Section Anti-Blanchiment du Service de Police Judiciaire. Les quatre autres membres de cette section se consacrent plus particulièrement aux enquêtes pénales proprement dites (enquêtes préliminaires, informations judiciaires, exécution d’ordonnances prises dans le cadre de l’exécution de certaines commissions rogatoires internationales dans lesquelles le blanchiment est libellé par l’autorité requérante).

There are 4.5 people including a secretary in the CRF stricto sensu plus the support of members of the Service de Police judiciaire.

The CRF acts under the supervision of the prosecuting authorities.

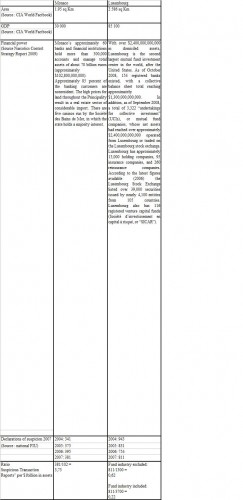

We have seen that the number of declarations of suspicion in Luxembourg is not consistent with the importance of assets managed. The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry excluded, is 6 times less than Monaco

If I take into accounts only banks, as I have a comparison point with Monaco, the number of declarations of suspicion in Luxembourg is not consistent with the business activity in the jurisdiction.

In 2007, of 156 banks, 63 only reported a declaration of suspicion, which is almost the number of banks in Monaco according to CIA World Factbook. This means that 60% of banks in Luxembourg never ever had a dubious client to be reported to the FIU. This is not serious and is definitely worrying for the enforcement of the AML procedures in the jurisdiction.

My observations are consistent with the Narcotics Control Strategy report 2009, which observes that in Luxembourg the scarce number of financial crime cases is of concern, particularly for a country that has such a large financial sector.

18:06 Posted in Comparison | Permalink | Comments (2)

03/16/2009

Declarations of suspicion : Luxembourg v. Monaco

The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry excluded, is 6 times less than Monaco

The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry included, is almost 17 times less than Monaco.

Some might have thought that my blog expresses some biased opinion, such as in this comment. Unfortunately they are fact. And they cannot fool the people behind the Narcotics Control Strategy report 2009, which observes that in Luxembourg the scarce number of financial crime cases is of concern, particularly for a country that has such a large financial sector.

There is a motto that is used by professionals in Luxembourg : They usually answer critics that what they criticize about Luxembourg ignores the law and the reality of the Luxembourg Financial Center. Comparing financial centers demonstrates that unfortunately Luxembourg is not at the level of the other jurisdictions.

I do believe that those who really support Luxembourg in the long term are not those who hush up issues or deny dysfunctions or even seem to justify them by calling upon the bad actions of others (sales of weapons...) True support comes from those who have a broad view and understanding of what is at stake in the world.

Who said five years ago: “We want to remain what we are. Yes, we want to remain what we are and for this reason, we must change to adapt and evolve. The world does not wait for us. And we should not wait for the world. We must go and meet it, otherwise it crushes us.”

Jean-Claude Juncker (Declaration of August 4th, 2004)

I am afraid he had bad advisors who ignore the laws and the realities of the world.

FIU Monaco report

FIU Luxembourg Report

CIA World Factbook

Narcotics Control Strategy report

19:34 Posted in Comparison | Permalink | Comments (0)

03/12/2009

Disciplinary activity: Auditors in Luxembourg v Auditors in Blegium

In the context of the financial crisis where auditors are in question, I went through the website of the registered auditors in Luxembourg and in Belgium.

There are almost 1000 registered auditors at the IRE in Belgium and 350 in Luxembourg.

Logically there should be a kind of proportionality in the disciplinary activity of both institutes all the more than Luxembourg is most important in business (GDP and GNP much higher).

In Luxembourg there are only two disciplinary judgements available online:

- one dated 16 June 2005 and

- one dated 30 June 2006.

In Belgium there are disciplinary judgements available online every year:

2005: 23

2006: 29

2007: 42

2008: 22

2009: 2 (at 12 Mars 2009)

From 2005 to 2008 the average is 29 disciplinary judgements every year.

I have already quoted two reports : The Narcotic Control Strategy Reports 2008 observes that “the scarce number of financial crime cases is of concern, particularly for a country that has such a large financial sector” and the GRECO report Round III observes that “the number of cases coming before the courts appears to be very small”

What they state is confirmed with the disciplinary activity of auditors in Luxembourg.

Sources:

IRE Luxembourg

IRE Belgium

06:58 Posted in Comparison | Permalink | Comments (0)