02/07/2009

UCITS Directive: Transposition definitely more faithful in Ireland than in Luxembourg

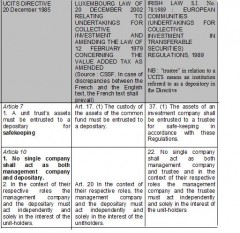

I have pointed out two provisions of the UCITS directive that I cannot find in the Luxembourg Law.

To balance the analysis, I wanted to know how the UCITS directive was transposed into the Irish law as Ireland is in question for Thema Fund.

The comparison is very interesting as the Irish legislation actually transposed the provisions that were not transposed in Luxembourg and whose absence definitely worsens the risk for the investor :

Large picture

The table may be downloaded here.

19:59 Posted in Comparison | Permalink | Comments (0)

11/15/2008

FACTBOX: Status of bank secrecy protection in Europe

Reuters has reported that Barack Obama's election as U.S. president will open up a new front in a growing campaign against Swiss banking secrecy, already under fire from Germany which wants the country put on a tax haven blacklist, officials said.

Reuters provided an overview of the situation in Europe for Liechtenstein, Luxembourg and Switzerland first .

Know more

06:31 Posted in Comparison | Permalink | Comments (0)

07/23/2008

The visible differences between Switzerland and Luxembourg as far as business ethics is concerned

As I wrote low taxes and banking secrecy are clues of tax haven, but the determining criterion is definitely permissiveness.

To demonstrate this permissiveness. It would compare below Switzerland, that the US Senate targeted explicitly, and Luxembourg; that said to have one of the most stringent anti-money laundering legislation in the world (Cf. Luxembourg Propaganda).

To begin with, the FATF admits links between corruption and money laundering. The FATF Plenary meeting that took place in Paris in October 2005 discussed the two-fold links between corruption and money laundering/terrorist financing: the proceeds of corruption are likely to be laundered; corrupt institutions are liable to impede efforts to stop money laundering or to counter terrorist financing.

Let's analyse a couple of items.

Communication of big four firms on fraud, corruption and other criminal business behaviours

PwC et E&Y in Switzerland participated to « Global Economic Crime Survey » for PwC and « Corruption or compliance – weighing the costs » for E&Y.

They are free to talk about criminal business behaviours.

PwC et E&Y in Luxembourg did not participate to « Global Economic Crime Survey » for PwC and « Corruption or compliance – weighing the costs » for E&Y. These surveys are even not communicated.

Communication of the regulatory body

The Swiss Federal Banking Commission largely and regularly communicates on its investigations, its sanctions and cases law especially in the Bulletins.

The CSSF communicates only once a year in its annual report with no details. The small number of sanctions is telling. The CRF, the Luxembourg FIU, does a pretty good job and does not hide issues. The CSSF and the CRF do not describe the same situations.

Communication of judiciary judgements in general

They are available on www.bger.ch in Switwerland.

They are not available in Luxembourg. What exists currently officially is a selection of jurisprudence considered as interesting (Cf. parliamentary question Nº2550 dated 21 May 2008 and Minister of Justice’s answer dated 2 July 2008).

Number of declarations of suspicion while the center is growing

It increased in 2007 in Switzerland (Cf. MROS report dated 2008).

It decreased in 2007 Luxembourg (Cf. Minister of Justice report 2007 pp. 136 to 140)

“Although Luxembourg has steadily enacted anti-money laundering and terrorist finance laws, policies, and procedures, the lack of prosecutions and convictions is telling, particularly for a country that boasts such a large financial sector”. (International Narcotics Control Strategy Report, US Departement of State, March 2007)

“The scarce number of financial crime cases is of concern, particularly for a country that has such a large financial sector.” (International Narcotics Control Strategy Report, US Departement of State, March 2008).

Quality of media as watchdog

Media play the role of watchdog in Switzerland.

Because of a public financing the press does not act as a watchdog in Luxembourg all the more than because of conflicts of interest due to the small size there is a pressure. There is no culture of investigation.

This was stated by the GRECO in a report early 2001: “the press, which has strong political affiliations, does not seem to exercise its role of public watchdog with the same vigour as in other countries. ” (GRECO Report dated 15 June 2001).

This was stated as well by the OECD in a report in 2004 : “The “watchdog” role of the media is also very limited in Luxembourg, although in some cases they have played a part, when detailed information fell in to their hands, in bringing to light suspicious behaviour. (…) According to media representatives interviewed, the shortage of financial and human resources available to the Luxembourg media generally preclude investigative journalism and consequently prevent the revelation of bribery cases” (OECD Report dated 28 May 2004).

It is interesting to see that the press in Luxembourg did not cover the hearing of the US Senate.

Liability of legal persons

GRECO took a particularly positive view of the seizure and confiscation system and of criminal liability on the part of legal persons (See GRECO Evaluation report dated 4 April 2008).

Luxembourg urgently needs to establish liability against legal persons for foreign bribery and put in place sanctions that are effective, proportionate and dissuasive, according to a report by the OECD's Working Group on Bribery (SEE OECD report dated 20 March 2008)

Luxembourg did not authorise the publication of latest GRECO report that remains confidential (see GRECO press release dated 9 – 13 June 2008).

Transparency International

There is a TI Chapter in Switzerland

1 % of respondents in Switzerland reported they paid a bribe to obtain a service (Cf. TI Global Corruption Barometer 2007)

There is no TI Chapter in Luxembourg

6 % (5% European average) of respondents in Luxembourg reported they paid a bribe to obtain a service (Cf. TI Global Corruption Barometer 2007)

The difference between both centers with banking secrecy is telling and allows to conclude that professional standing is a charade in Luxembourg despite clear legislation that business and political leaders says to be pragmatic, with definitely the meaning of lax

I have been warning leaders either political or professional in Luxembourg since 2003 to implement corrective actions to fight permissiveness, dysfunctions and deficiencies that weaken the business of investment funds and the country in general: Academic project of research about ethics and CSR that was not accepted late 2004, articles as of December 2005, book in May 2006, blog...

But there is definitely no will to do so and I have a feeling that there is a kind of headlong flight because there is a strong feeling of impunity because of the "system" that does not exist in Switzerland.

07:30 Posted in Comparison | Permalink | Comments (0)