08/04/2009

Tax Havens: International Tax Avoidance: the figures

Comment:

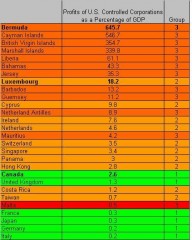

1. Median: 4.4

2. Canada is leader of the "G7" group

3. Luxembourg is leader of the "Larger Countries (GDP At Least $10 billion) on Tax Haven Lists and the Netherlands" group

4. Bermuda is leader of the "Small Countries on Tax Haven Lists" group

5. Luxembourg 8th jurisdiction every category (See list of US companies in Luxembourg)

6. All the jurisdictions before Luxembourg are small countries on tax haven lists

7. There are 5 jurisdictions after Luxembourg that are small countries on tax haven lists

8. The first jurisdiction of the G7 group (Canada) is 20th.

Luxembourg Prime Minister is quoted in the report page 10: "Luxembourg Prime Minister Jean-Claude Junker urged other EU member states to challenge the United States for tax havens in Delaware, Nevada, and Wyoming"

His name is misspelled like the word that means “something (as an automobile) of such age and condition as to be ready for scrapping (See Junker in the dictionary)

Is it a the work of the unconscious?

Jean Claude Juncker is the oldest active political governmental leader in the European Union.

He did not see the hurricane on tax havens coming.

It is very interesting to read again all of Juncker’s annual speeches before the parliament. In particular the one he gave last year whereas the text of the Levin, Coleman and Obama bill was known and that the Liechtenstein scandal took place. In 2008, Angel Gurria stated that "Excessive bank secrecy rules and a failure to exchange information on foreign tax evaders are relics of a different time and have no role to play in the relations between democratic societies"

In 2008, Jean-Claude Juncker

- did not speak about the problems of banking secrecy ("secret" : word missing)

- did not speak about the problems of tax evasion ("évasion" : word missing)

- did not speak about the problems of tax haven ("paradis" : word missing)

- did not speak about the abuses the offshore ("offshore" : word missing, "domiciliation" : word missing)

- did not speak about fraud ("fraud" : word missing)

-…

The former years he had spoken about these issues but definitely ignored their acuity in 2008.

In a nutshell, he did not see or did not want to see that he was up against the wind that now is blowing in his face.

He is once again Prime Minister after the General Elections. On 29 July 2009, the new government published the official version of its programme for the period 2009 - 2014. As far as the financial centre is concerned, the government foresees the following priority initiatives (Source: LFF):

- Pro-active support policy for the development of the financial centre as a main pillar of the Luxembourg economy.

- Strengthening of the international orientation of the financial centre. In European negotiations, the Government will ensure that all obstacles to an efficient working of the internal market shall be removed.

- Besides contributing to the development of the international activities linked to wealth management and investment funds, the government intends to diversify the activities of the financial centre (micro-finance, SRI, Islamic finance, philanthropy as a corollary to private banking).

- Geographical diversification of the financial centre. Besides the traditional European markets, the government will attract new investors from other regions, by making the centre better known in, amongst others, the Americas, Asia and the Gulf countries. The network of double tax treaties shall also be extended to the countries of origin of new potential investors.

- In order to ensure the legal security of new financial products, the government will accompany them with an appropriate legal framework. Particular attention will be paid to investor protection. The Government will closely monitor legal developments in other countries in order to safeguard the competitiveness of the Luxembourg financial sector.

- The Government places great importance on the professional supervision of the financial sector and will actively contribute to international and European developments in the matter. With a mind to prevent risks, the government will encourage cooperation and exchange of information mechanisms amongst competent national and European actors

There is nothing to correct the abuses that create the “tax haven”:

- There is nothing about strengthening supervision and sanctions.

- There is nothing about sanitizing the judicial and regulatory haven.

- There is nothing about revising and correcting the transposition of directives17:20 Posted in Comparison | Permalink | Comments (0)

The comments are closed.