07/31/2009

Depositor & Investor Compensation Schemes: Luxembourg v. France v. Belgium

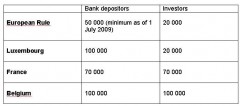

Figures (in EUR)

As far as investors are concerned, the Directive sets a Community minimum level of compensation per investor of Euro 20 000, while at the same time authorising Member States to provide for a higher level of compensation if they so wish. However, certain categories of investors may be excluded by Member States from the scheme's coverage or may be afforded a lower level of coverage. The arrangements for organizing and financing schemes are left to the discretion of Member States.

Clever investors will realize they seem less protected in Luxembourg than in France or Belgium, that both go beyond the directive.

Source:

07:38 Posted in Comparison | Permalink | Comments (0)

07/22/2009

Luxembourg regulator much better than Irish regulator to communicate on Madoff

I have raised that the Luxembourg regulator is much better than Irish regulator in the communication on Madoff.

The Irish regulator this week published its annual report 2008. It ignores Madoff despite Thema fund.

The Luxembourg regulator had published its annual report 2008 a couple of weeks ago. It does not condone Madoff.

20:07 Posted in Comparison | Permalink | Comments (0)

04/21/2009

Swiss cheese is not as good as it used to be and Luxembourg sells a stinking cheese.

In the previous article relating to Luxembourg I have evoked the impossibility for the actors in the Luxembourg jurisdiction to deal with change.

My wording was based on Spencer Johnson’ famous book: “Who moved my cheese”

I am afraid Switzerland did not realise either the paradigm shift.

In an article Didier Remer lays emphasis on the Swiss situation.

Angel Gurría confirmed in the columns of le Temps that banking secrecy was in question and that the engine was launched, that it would not stop, that the collision was imminent

Swiss leaders were informed of the evolution of international mentalities, and systematically informed on collaboration between OECD and G20.

Additionally, neither Switzerland nor Luxembourg attended the OECD meeting last October, which was the beginning of the process of the reviewing of the OECD list.

The jurisdiction is not exactly in the same situation as Luxembourg. It has a long tradition of finance. It has various alternative industries to finance. And as Didier Remer observed there is a political debate.

(in an article I had highlighted huge business differences between both jurisdictions. )

To the contrary, in a recent interview, Jean Asselborn, who is Vice Prime Minister of Luxembourg stated (in order to soothe and to reassure?) that there is still the fund industry in Luxembourg which has great competences, and many countries trust us, and that there are as well the credit markets (il y a d’autres atouts. Par exemple, au Luxembourg il y a l’industrie des fonds qui a des grandes compétences et beaucoup de pays se fient à nous. Il y a aussi tous les marchés des crédits.)

The problem is that with Jean Asselborn’s statement Luxembourg goes on selling a stinking cheese with

- the Madoff story that just did not happen by chance in Luxembourg, and

- Bank Landsbanki that went bankrupt in a dubious context

- etc.

The problem is that Jean Asselborn belongs to the left wing of the governing coalition.

Which demonstrates that no politician in Luxembourg never ever questions the dysfunctions.

18:38 Posted in Comparison | Permalink | Comments (0)