09/10/2009

Redlands police arrest Briton in investment fraud case

Redlands police arrested a British national Monday on suspicion of bilking several people out of at least $100,000.

Investigators found that he sent the money to an overseas account in Luxembourg.

Why a student located in the USA in California may chose Luxembourg for an investment fraud scheme ?

Because the jurisdiction has a worrying reputation for crooks to choose it.

06:27 Posted in Luxembourg | Permalink | Comments (0)

09/09/2009

LFF : Peinlich, peinlich, peinlich

Who states half-truths and concocted lies?

You probably remember my article "Client does not come first in Luxembourg whereas the communication is deceptive, which is "peinlich, peinlich, peinlich” that was posted a couple of days ago.

I was quoting Luxembourg for Finance.

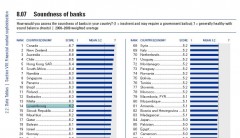

LFF removed one word in the description of the scale: the original report states “7 = generally healthy with sound balance sheet” whereas LFF states with no care “7.0 (healthy with sound balance sheet)”. They disregarded specific instances.

This communication about the so-called “recently published World Economic Forum global ranking index for countries” took place on 12 June 2009 whereas the report was actually published in October 2008.

I said I would comment the data in the new report, which was actually published yesterday.

Report 2008-2009

Report 2009-2010

To be logical with its communication, LFF should admit that the decrease from the second rank to the sixth rank is the result of an unhealthy banking sector and poor level of investor protection.

Unless it admits the World Economic Forum's Global ranking index for countries with safe banking practices is based on the opinions of executives in the industry and banks and is not so relevant.

Anyway, in both cases, the communication in June was definitively a mistake as what was published in 2008 did not take into account the issues raised by banks located in Luxembourg late 2008 (Landsbanki Luxembourg, Kaupthing Bank Luxembourg).

LFF was both deceptive and unprofessional as it could not ignore in June the probable impact and that another report would be coming soon.

As I wrote, the visible truth in public and official sources is that the client does not come first in Luxembourg:

- the client does not exist in the regulator’s Committees: The members of these Committees represent the companies subject to the prudential supervision of the CSSF, professional associations representing the various segments of the financial sector as well as external auditors and legal advisers active in the financial field.

- the regulator does not inform of every complaint filed with the State Prosecutor’s office.

- the jurisprudence is not in favor of the investor : despite the fact that there is poor transparency on judgements, as explained attorney Alex Schmidt, the investor is not protected in Luxembourg when banks failed in their duty. In a book called La Responsabilité du Banquier en droit prive luxembourgeois (Banker’s liability in Luxembourg private law) he concludes that one could be pleased in that Luxembourg jurisprudence generally is very clear-sighted vis-a-vis the small investors (original text: “L'on pourra se féliciter de ce que la jurisprudence luxembourgeoise se montre généralement très clairvoyante face aux investisseurs à la petite semaine”). In other words in case of litigation because of a bank failure, there is a country risk as the foreign investor will not be successful before the court.

LFF can rewrite the history and the stories, kill professionally critics that are considered as dissidents…, propaganda (i.e. ideas, facts or allegations spread deliberately to further the Luxembourg banking sector’s cause) does not work anymore.

Facts are there, in public and official sources that are the visible part of the iceberg in this secrecy jurisdiction.

I am afraid Jean Meyer does not have the right persons in his team.

I am looking forward to commenting the next blunder.

17:28 Posted in Luxembourg | Permalink | Comments (0)

Calculations

To depreciate Rainer Falks’ study, ABBL observes that in the study the financial centre supposedly collected around 500 billion euros ($723 billion) in defrauded money originating from developing countries, even though in Private Banking the centre manages a total that amounts to less than 300 billion euros ($434 billion).

But in the previous paragraph ABBL mentions investment funds. The 300 billion does not take into account these assets in the total assets present in Luxembourg, nor does it consider other financial vehicles available. For funds we have 1,706 billion euros ($2469 billion) as at 31 July 2009.

So we have roughly 2,000 billion euros ($2895 billion), of which 500 billion euros ($723 billion) might be defrauded money originating from developing countries (25%)

ABBL’s press release was definitely entirely biased

Egide Thein provided a very interesting calculation.

Although the full extent of the transfers of illicit funds or assets is impossible to measure with precision, there can be very little doubt that corruption and the laundering of proceeds derived from corruption has a cancerous effect on economies and politics around the globe. The International Monetary Fund (IMF) has estimated that the total amount of money laundered on an annual basis is equivalent to three to five per cent of the world’s gross domestic product (GDP), globally at $800 - $ 2,000 billion per year (figures for 2002)

Transparency International and Kroll consider that international corruption, on contracts only, generates at least $500 billion annually, or 10% of those contracts.

Considering these facts and figures, it is statistically plausible to estimate that dirty money is spread across financial centers worldwide on a pro rata base to other deposits

One estimates the total deposits in private banks in the world to be over $ 15.500 billion.

It suffices to estimate the percentage held by institutions in Luxembourg, say 10% for ease of calculation, which is realistic, especially in adding all the other forms of deposits.

There is a great risk therefore there are also

- 10% of worldwide bribes (or $ 50 billion) and

- 10% of global money laundering (or $ 80 - $ 200 billion).

The above are rough figures because the data are under banking and professional secrecy (and detractors of Rainer’s study are not of good faith as they are those who support banking and professional secrecy and do not like truth and transparency) but they are realistic enough for smart professionals to make amend and admit possible failures in the regulation.

But they cannot go back to their own decisions as they decide what is to be enforced for the regulation:

“The Luxembourg Investment Fund Industry has regularly had a very close and direct say on the evolution of the Luxembourg prudential regulatory environment governing the collective Investment Industry (...) This influence has been exerted directly and indirectly by the lobbying initiatives taken on the level of the different professional associations, be it ALFI or ABBL, but also and more importantly, trough a direct association with the Luxembourg Supervisory Authorities by means of a number of standing committees" (Rafik Fischer, Vice Chairman, ALFI, in 2005)

This abnormal influence on the regulator by the regulated beyond consultative opinion is confirmed by the CSSF itself: "The internal committees assist the CSSF in the analysis of the development of the different financial sector segments, give their advice on any question relating to their activities and participate in the drawing-up and the interpretation of regulations relating to their specific field."

In other words professionals in Luxembourg require what they want in the regulation whatever matter (AML, tax, audit...) and whatever area (requirements, sanctions...)

07:06 Posted in Luxembourg | Permalink | Comments (1)