09/09/2009

LFF : Peinlich, peinlich, peinlich

Who states half-truths and concocted lies?

You probably remember my article "Client does not come first in Luxembourg whereas the communication is deceptive, which is "peinlich, peinlich, peinlich” that was posted a couple of days ago.

I was quoting Luxembourg for Finance.

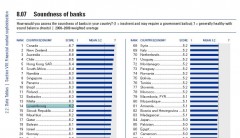

LFF removed one word in the description of the scale: the original report states “7 = generally healthy with sound balance sheet” whereas LFF states with no care “7.0 (healthy with sound balance sheet)”. They disregarded specific instances.

This communication about the so-called “recently published World Economic Forum global ranking index for countries” took place on 12 June 2009 whereas the report was actually published in October 2008.

I said I would comment the data in the new report, which was actually published yesterday.

Report 2008-2009

Report 2009-2010

To be logical with its communication, LFF should admit that the decrease from the second rank to the sixth rank is the result of an unhealthy banking sector and poor level of investor protection.

Unless it admits the World Economic Forum's Global ranking index for countries with safe banking practices is based on the opinions of executives in the industry and banks and is not so relevant.

Anyway, in both cases, the communication in June was definitively a mistake as what was published in 2008 did not take into account the issues raised by banks located in Luxembourg late 2008 (Landsbanki Luxembourg, Kaupthing Bank Luxembourg).

LFF was both deceptive and unprofessional as it could not ignore in June the probable impact and that another report would be coming soon.

As I wrote, the visible truth in public and official sources is that the client does not come first in Luxembourg:

- the client does not exist in the regulator’s Committees: The members of these Committees represent the companies subject to the prudential supervision of the CSSF, professional associations representing the various segments of the financial sector as well as external auditors and legal advisers active in the financial field.

- the regulator does not inform of every complaint filed with the State Prosecutor’s office.

- the jurisprudence is not in favor of the investor : despite the fact that there is poor transparency on judgements, as explained attorney Alex Schmidt, the investor is not protected in Luxembourg when banks failed in their duty. In a book called La Responsabilité du Banquier en droit prive luxembourgeois (Banker’s liability in Luxembourg private law) he concludes that one could be pleased in that Luxembourg jurisprudence generally is very clear-sighted vis-a-vis the small investors (original text: “L'on pourra se féliciter de ce que la jurisprudence luxembourgeoise se montre généralement très clairvoyante face aux investisseurs à la petite semaine”). In other words in case of litigation because of a bank failure, there is a country risk as the foreign investor will not be successful before the court.

LFF can rewrite the history and the stories, kill professionally critics that are considered as dissidents…, propaganda (i.e. ideas, facts or allegations spread deliberately to further the Luxembourg banking sector’s cause) does not work anymore.

Facts are there, in public and official sources that are the visible part of the iceberg in this secrecy jurisdiction.

I am afraid Jean Meyer does not have the right persons in his team.

I am looking forward to commenting the next blunder.

17:28 Posted in Luxembourg | Permalink | Comments (0)

The comments are closed.