09/24/2009

Islamic finance: the Damocles" sword

Everyone in Luxembourg is particularly exited about making money with Islamic Finance.

As I wrote this may be a new cheese for the jurisdiction.

PwC Luxembourg, the audit leader in Luxembourg, has just published a press release about the opportunity.

But there is a critical issue that they probably ignored.

What would do Luxembourg if another jurisdiction (the USA for example) would require the freezing of accounts of persons suspected of terrorism and/or the communication of data relating to their accounts, whereas a terrorist organisation would threaten Luxembourg?

17:21 Posted in Luxembourg | Permalink | Comments (0)

Global Corruption Report 2009: a misleading report

I went through the Global Corruption Report 2009: Corruption and the Private Sector that was released yesterday by Transparency International.

The press release states that The Global Corruption Report 2009: Corruption and the Private Sector (GCR) shows how corrupt practices constitute a destructive force that undermines fair competition, stifles economic growth and ultimately undercuts a business’s own existence. In the last two years alone, companies have had to pay billions in fines due to corrupt practices. The cost extends to low staff morale and a loss of trust among customers as well as prospective business partners.*

The paragraph "Poverty and corruption is worth commenting.

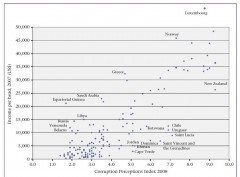

Whereas the designer of the CPI has just repudiated the methodology and called TI to start anew to educate TI-S yo deliver an acceptable product, TI states that a simple plot reveals a close association between a good performance in the CPI 2008 and income per head (p 395 of the report, 429 of the file).

The graph page 396 (430 of the file) that is based on the CPI is a charade: it seems to say that the richer a juristiction is, the less corruption it has.

.

Luxembourg is the only jurisdiction out of the core graph. So it is in the spotlight.

What else is said in the report about Luxembourg?

Page 135 (169 of the file) : "The OECD Anti-Bribery Convention, for example, requires sanctions for accounting violations related to bribing foreign public offi cials to be ‘effective, proportionate and dissuasive’.A progress report in 2006 identified a lack of clear legal obligations in many countries for auditors and accountants to report suspicions of crimes to the authorities, however. In addition, the report faulted several countries, including Australia, France, Italy and South Korea, for insuffi cient and ineffective sanctions such as low maximum fines and suspended sentences, and countries such as Belgium, Hungary, Luxembourg and Slovakia for weak enforcement".

Page 138 (172 of the file): "By 2008 more than US$1.2 billion had been repatriated from accounts in a number of countries, including Belgium, Liechtenstein, Luxembourg, Switzerland and the United Kingdom (including the crown dependency of Jersey"

I have commented last year blatant inconsistencies when the CPI 2008 was released:

- incoherence with TI Barometer,

- incoherence with GRECO and OECD reports on corruption,

- official business culture: money over ethics,

- conflicts of interest because of the small size

- trend to hush up issues with a press thas is do playing the role of watchdog.

In the recent history,

- Luxembourg is the only EU State member unable to provide data on corruption for the follow up of the OECD Anti-bribery Convention by TI and therefore what is said page 135 (169 of the file) based on a report in 2006 is misleading as it does not take into account the recent observations,

- Luxembourg is the only so called democratic jurisdiction that deny the right for NGOs to to their job of watchdog ,

- Luxembourg did not enforce the criminal liability for legal persons despite an injunction last year (Working Group on Bribery) and this year (Mark Pieth on behalf of the OECD’s Working group on Bribery).

Tax havens are not an issue for Transparency International (it is however notably for the French chapter) even though "tax haven" is quoted 12 times in the report (but not in the press release: neither "tax haven" nor "offshore" are quoted and not in the Executive summary: : neither "tax haven" nor "offshore" are quoted).

A google search of "tax haven" on TI website (site:transparency.org "tax haven") shows 9 results, only 9:

There are 145 résults on TI France website (site:transparence-france.org "paradis fiscaux")

I will quote Richard Murphy:

"Transparency International had a purpose: that purpose has gone, destroyed in no small part by its own small mindedness and the willingness to ignore the risk that sponsorship could be corrupting.

There is a need for a new index: the Tax Justice Network will launch it in October when our Financial Secrecy Index will be made available for the first time. The results look very, very different from those TI have promoted. Corruption is not now an issue in some far away place. It will be an issue very close to where many readers of this blog are. And that’s exactly what TI should have been saying for a long time and failed to do."

As Einstein said, "We can't solve problems by using the same kind of thinking we used when we created them"

06:12 Posted in General | Permalink | Comments (0)

09/23/2009

Liechtenstein signs tax deal with Monaco

Liechtenstein has just signed an agreement with Monaco to exchange information on fraud and tax evasion based on the OECD tax model.

The jurisdiction has now half of the required agreements (6 out of 12).

Agreements with San marino and Ireland and initialed.

07:29 Posted in Liechtenstein | Permalink | Comments (0)