06/28/2009

Luxembourg: the slow-witted EU jurisdiction in the fight against corruption (update)

TI has just published a report on the enforcement of the OECD Bribery Convention.

In the report it is stated page 7 that “No TI reports were prepared for three countries, Estonia, Iceland and Luxembourg, since TI lacks experts in those countries, but TI Estonia provided current data on cases and investigations”.

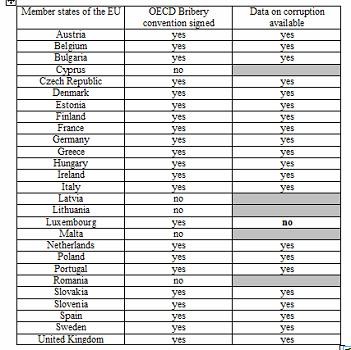

It appears that in the tables data are actually missing only for two jurisdictions: Iceland, the jurisdiction that went bankrupt, and Luxembourg.

As far as Iceland is concerned, the jurisdiction is not an EU Member State. It has just hired Judge Eva Joly to tighten up the ship on the economic collapse and related crimes. There is no doubt that thanks to this powerhouse in the fight against corruption, the jurisdiction will be able to provide data in the future. But Eva Joly faces problems and said she would quit unless radical changes are implemented to prevent conflicts of interest and provide relevant means.

As far as Luxembourg is concerned, to begin with it is interesting to observe that the TI report confirms the relevance of my comparison Luxembourg v. Switzerland in favour of Switzerland as Switzerland is very well ranked in the enforcement of the OECD convention.

Additionally, among the EU Member States that signed the OECD convention (most States) Luxembourg distinguishes itself, as it is the only jurisdiction that is unable to provide data, which is telling for a jurisdiction that is an important financial center despite it is a tiny state.

As I explained, because of its small size, there are many conflicts of interest that may turn de facto into objective corruption situations without money paid, what is called the "system".

Networks

There are many associations in Luxembourg, but the center is very small so everybody meets in the same associations and when there is an issue involving a member a couple of phone calls to fellow member may help to hush up the issue. Everybody in the network knows the issue but there is no need to repudiate the bad professional that is supported by the group. To consolidate the support fellow members may knowingly join a board with the member in question. The problem in Luxembourg is that it is visible because of the small size, which is not the case in a bigger country where the bad professional may move up to another state to join the same kind of association but with new fellow members.

Intimidation

This situation is met when people do not do their duty because they fear for their job. This is particularly verified

- for internal auditors and compliance officers because of the subordination in the framework of the employment contract,

- for external auditors because of the business contract especially in a country where the leader of audit focuses on its growth and clients' confidence (not stakeholders'), which is not compatible with international professional provisions relating to audit ethics. This situation may explain the reason why there are so few declarations of suspicion (only 4) from auditors, which was considered suspect by the CRF, the Luxembourg FIU (Cf. for example Report 2003-2004, page 8 , were the number of 3 (close to 4) was said "ridiculously low for a profession composed of 304 members individual and having access to all the financial information of the center")

Fame

This last type of situation is met when people may hesitate to do or do not at all do their duty because they do not want to involve people that gain a professional standing because of professional, political or academic supports (in a board, in an association...). In other word, the will is to protect the frontage of the reputation of the center and its professional in any case. This is particularly verified

- for the media that have a public financing and globally do not have the culture to criticise the "system" and to tighten up the ship (even though there are exceptions),

- for justice, that lacks means (Cf. report "Petita Pro Nova Justitia" issued by the Cercle Joseph Bech), a perfect illustration of this problem being the delay to judge sensitive affairs and the absence of judgements database.

The decision of the CSSF on UBS about Madoff is perfect illustration of how the "system" works with a wrong perception of the stake as the case is not internal.

Management of UBS/Luxalpha were close to Management of the CSSF, in CSSF Committees for example.

The CSSF did not sanction UBS where there would have been a sanction in any other jurisdiction.

I do not think that Luxembourg, where the criminal liability for legal persons does not exist despite an injunction last year by the OECD, may be credible with the launch of the LIGFI to promote worldwide stronger ethical practices and standards based on the principles of integrity: transparency, fairness, responsibility and accountability.

11:36 Posted in Luxembourg | Permalink | Comments (0)

EFAMA: promotion of the lack of rigor against the investors’ interests

EFAMA, the European Fund and Asset Management Association, has announced that Mr Claude Kremer was appointed as Vice-President Mr Claude Kremer is Chairman of the Association of the Luxembourg Fund Industry (ALFI). He is also a founding partner and head of Investment Management of the law firm of Arendt & Medernach, based in Luxembourg.

EFAMA never answered my question on the failures of the Luxembourg UCITS legal and regulatory frameworks where Commissioner Mc Creevy did (detailed e-mail from Niall Bohan, Head of Unit. DG MARKT G4. European Commission, dated 19 March 2009).

It is before the EFAMA that the ALFI presented in January its deceptive views on the Madoff affair and its implications for the Luxembourg fund industry.

What was officially said definitely does not comply with the reality, which was confirmed later by two main facts late May:

1. Commissioner McCreevy admited failures in the transposition of the liability of depositories.

2. The Luxembourg regulator did not sanction UBS and admitted that UBSL shall have to indemnify a UCI depositor according to its obligations as a Luxembourg depositary bank, subject to valid and opposable contractual clauses to the contrary and, as the case may be, to a court decision in such matter.

In this context, I am afraid the appointment this month is not of good omen for the investor’s protection.

09:54 Posted in General | Permalink | Comments (0)

The European governance model will be made from Luxembourg: the plan B after the LIGFI was stillborn?

The European Corporate Governance Institute (ECGI) and the University of Luxembourg a couple of days ago signed an agreement towards the establishment of a new entity, the European Corporate Governance Research Foundation (ECGRF), in Luxembourg. The announcement of the agreement was made at a conference on “Corporate Governance in Crisis?”, which assembled a distinguished group of researchers under the High Patronage of European Commission President, José Manuel Barroso. The event was held a week after G8 Finance Ministers made corporate governance the first of five categories in the Lecce Framework (In Lecce, Italy on 13 June 2009, the G8 Finance Ministers agreed on common principles and standards for propriety, integrity and transparency, what is called “The Lecce Framework”.)

As explained, since its foundation in 2002, the ECGI has established itself as the largest and most prestigious group of academics working in the field of corporate governance in the world. It has as its research members the most prominent researchers in economics, finance and law in both Europe and North America. It has a growing base of individual and corporate practitioners with a shared interest in corporate governance. It has organised high profile conferences that have been at the forefront of academic debate and at the top of the policy agenda. It has exposed leading practitioners and policymakers in Europe and across the Atlantic to the latest facts, academic thinking and analysis; and it has demonstrated that it has the managerial capabilities to organise activities and events of the highest quality and to the highest standards.

It is stated that ECGI's activities are complementary to those of the University of Luxembourg’s dynamic Faculty of Law, Economics and Finance that stands to benefit from ECGI's scientific potential, international reach and privileged contacts. While housing and materially supporting ECGI, the University has fully recognised that ECGI's intellectual and organic independence must be entirely preserved and governance provisions have been foreseen to ensure this

There are two main contact persons: Marco Becht, ECGI Executive Director, and Prof. Dr André Prüm, Dean of the Faculty of Law, Economics and Finance of the University of Luxembourg

One can have two readings: a negative one and a positive one.

The negative reading

As the LIGFI was stillborn, Luxembourg may have managed to have another international body in the same fields to enhance its good international reputation. There are links for a long time between Luxembourg and André Prüm on the one hand and Marco Becht on the other hand:

For example:

- Marco Becht was speaker at a conference with André Prüm two years ago.

- He was speaker at a conference where André Prüm was as well speaker in 2005

It is stated that the Council of the Foundation will marry the same general characteristics as that of the ECGI, while the presidency like two other seats, one university and the other not, will be reserved for candidates proposed at the beginning of Luxembourg.

The positive reading

The European Corporate Governance Institute (ECGI) is not an empty shell and the agreement may enhance the international pressure on Luxembourg to brush up its governance as there are huge concerns about governance in Luxembourg, that does not comply with the common principles and standards for propriety, integrity and transparency:

A couple of facts

Propriety

· In Luxembourg, anyone can be statutory auditor (Cf. law of 10 August 1915 on commercial companies as amended). There are statutory auditors that are neither members of the IRE (institute of registered auditors) nor the OEC (institute of chartered accountants), including auditors registered in exotic jurisdictions and that only exist in the Luxembourg Corporate Registration. Nobody controls them.

· In Luxembourg, there are many “red flags” in the Corporate Registration of offshore scams including with non-cooperative jurisdictions. Exotic companies, i.e. companies that are registered in non-cooperative jurisdictions and that only exist in the Luxembourg Corporate Registration, may be shareholder and/or auditor of Luxembourg-registered companies.

Integrity

· The Luxembourg Bankers’ Association, where external auditors – those guys who certified the accounts - are members, explained in the framework of the transposition of the second directive that offences such as forgery, use of forgery, false balance sheet, use of false balance sheet or unauthorised use of corporate property are vague and ambiguous (See ABBL report 2003 page 22 for instance). Nobody repudiated the statement.

· Nobody in Luxembourg, either politicians or professionals, told the truth on the transposition of the UCITS Directive. The discrepancies between the Luxembourg legal and regulatory framework and the UCITS Directive are clear enough.

Transparency

· In Luxembourg there is no transparency: no data about corruption, no judiciary judgements easily available…

· In Luxembourg, because of the small size there are many conflicts of interests, many cases of "professional incest". The direct consequence is the small number of crime cases or corruption cases, which are of concern in official reports (See Narcotic Control Strategy report and GRECO report Phase III about Luxembourg).

And so on.

Will Luxembourg use the new body to influence the European policies and promote its view, or to do the brushing up of its governance?

It very quickly will be known.

08:11 Posted in Luxembourg | Permalink | Comments (0)