02/07/2009

UCITS Directive: Transposition definitely more faithful in Ireland than in Luxembourg

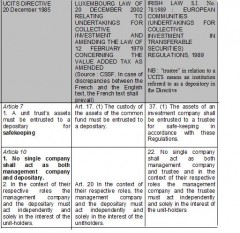

I have pointed out two provisions of the UCITS directive that I cannot find in the Luxembourg Law.

To balance the analysis, I wanted to know how the UCITS directive was transposed into the Irish law as Ireland is in question for Thema Fund.

The comparison is very interesting as the Irish legislation actually transposed the provisions that were not transposed in Luxembourg and whose absence definitely worsens the risk for the investor :

Large picture

The table may be downloaded here.

19:59 Posted in Comparison | Permalink | Comments (0)

The evidence of words and the standardized lie

Whereas on the one hand the CSSF has just made a concise official statement announcing that it finished its investigations, and that it has agreed with UBS to "cooperate in their efforts to determine the relevant facts and define the way forward in close conjunction with all others who are affected by the events in order to find a solution as soon as possible" and on the other hand the official statements (Minister of Justice, CSSF, ALFI...) claim that the legal and regulatory framework in Luxembourg complies with the European directive, I am afraid that everyone in the business in Luxembourg is not telling the truth for something that is very easy to check with a synoptic table of the transposition.

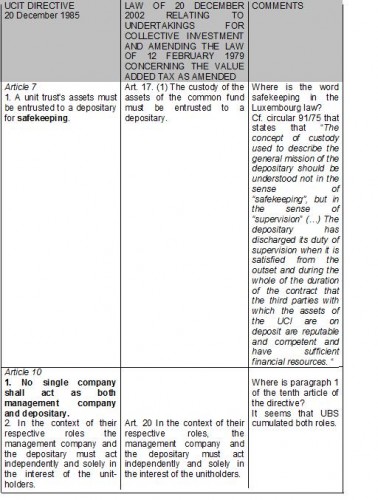

Two critical provisions in the directive to protect the investors have been knowingly removed because of influences from the financial sector (lawyers, auditors, banks) like for any topic in the name of pragmatism.

The two paragraphs are the following.

The full synoptic table may be downloaded by clicking here.

As long as the leaders either politicians or professionals that do not tell the truth on things easy to check will not have been changed in the jurisdiction there will be an unquestionable risk for the investors.

The communication was and is pitiful : they did not make amend.

Those in place do not have anymore credibility.

08:13 Posted in Luxembourg | Permalink | Comments (0)

02/06/2009

Wooden language from the CSSF

The CSSF today issued two press releases that are worth commenting.

The first press release is in English French, and German. It states in English: “UBS and the CSSF have met on February 5, 2009 to discuss the circumstances of Luxalpha SICAV – American Selection and Luxembourg Investment Fund - US Equity Plus, two Luxembourg funds which have been hit by the Madoff scandal. Pursuant to those discussions, UBS and CSSF have agreed to cooperate in their efforts to determine the relevant facts and define the way forward in close conjunction with all others who are affected by the events in order to find a solution as soon as possible.”

“to determine the relevant facts and define the way forward in close conjunction with all others who are affected by the events “ What a wooden language. I cannot include/understand such tergiversations for a situation that is clear enough. The jurisdiction should answer honestly 4 simple questions to face its responsibilities:

1. Was UBS both the depositary and the management company? If that is proven, it does not comply with the European directive that states that “No single company shall act as both management company and depositary “ (article 10 of the UCIT Directive dated 20 December 1985) and the Luxembourg law of 20 December 2002 seems to have removed the requirement in its article 20. This would mean that by not transposion the important requirement the legislative power would have failed in its duty to protect the investor.

2. Did UBS transfer the role of depositary? If that is proven, it is the result of a lax wording on the depositary in circular IMF 91/75 that states that “The concept of custody used to describe the general mission of the depositary should be understood not in the sense of “safekeeping”, but in the sense of “supervision” (…) The depositary has discharged its duty of supervision when it is satisfied from the outset and during the whole of the duration of the contract that the third parties with which the assets of the UCI are on deposit are reputable and competent and have sufficient financial resources. “. This would mean that by using a lax wording the CSSF would have failed in its duty to protect the investor.

3. Did the auditor as individual demonstrate a superficial behaviour that does not comply with what is expected from such professional who certifies the accounts (posing in a leisure magazine with a glass of wine...)? If that is proven it would mean that by not controlling the staff the auditor as legal person would have failed in its duty to protect the investor.

4. Did the auditor as legal person demonstrate affinities with UBS management which may reveal a breach in the independence of the audit firm? If that is proven it would mean that by not assuring the independance of the registered firms the IRE (Institute of Registered Auditors) would have failed in its duty to protect the investor.

I am looking forward to reading the official answers.

The second press release is only in French. It states only : “Comme annoncé dans le communiqué du 3 février 2009, la CSSF a remis le résultat de son enquête sur les différentes responsabilités, en application des textes légaux et réglementaires, qui incombent à la banque UBS (Luxembourg) S.A. dans sa fonction de dépositaire du fonds d’investissement LUXALPHA SICAV. La CSSF a demandé à la banque de prendre position par écrit » (free translation: As announced in the official press release of February 3, 2009, the CSSF gave the result of its investigation on the various responsibilities, pursuant to the legal and regulatory texts, which fall on bank UBS (Luxembourg) S.A. in its function of depositary of the funds of investment LUXALPHA SICAV. The CSSF required that the bank take written position.)

To whom the result was given? It is not specified. The report should be published.

19:52 Posted in Luxembourg | Permalink | Comments (0)