03/11/2009

You saddle today and ride out tomorrow

Almost three years ago, I had warned the professionals and the politicians in Luxembourg of the paragigm shift:

This is what I wrote :

To ensure the sustainability of the financial center, Governing authorities must be aware of the changes to the geopolitics and the geoeconomics : we live at a time of transparence and governance with various programs (OECD, World Bank...).

Governing authorities must ask questions and accept questions especially on compliance issues. They must tighten up the ship on issues all the more than there are alternative financial centers for investors and head offices of banks. Otherwise they weaken their international credibility.

The failure to ask or to answer questions allows these authorities (either political or professional) to operate with a distorted sense of reality. In fact, Finkelstein calls companies that are unable to question their prevailing view of reality zombies. A zombie company, he says, is “a walking corpse that just doesn’t yet know that it’s dead—because this company has created an insulated culture that systematically excludes any information that could contradict its reigning picture of reality”.

Read original text

07:08 Posted in Luxembourg | Permalink | Comments (16)

The twilight of the Luxembourg financial center for frauds

Yesterday Luc Frieden answered verbally a parliamentary question.

The transcription of what he said was circulated.

A couple of paragraphs are worth commenting as they demonstrate that Luxembourg in the current context will not be able to make the necessary aggiornamento as leaders deny the specific problems in the jurisdiction.

Le G20 n’est ni une organisation internationale, ni un organisme pouvant arrêter des critères juridiquement contraignants (G20 is neither an international organization, nor an organization which can decide constraining criteria)

The statement is arrogant and forgets that some G20 members are major contributors to the OECD and FATF that could make a pressure.

Le Luxembourg n’est ni un paradis fiscal, ni un territoire non coopératif, puisqu’il applique l’ensemble des règles prudentielles et fiscales en vigueur dans l’Union européenne (Luxembourg is neither a tax haven, nor a non-cooperative territory, since it complies with the whole of the prudential and tax rules in the European Union)

The debate is on the relevance of the existing rules that are not strict enough.The OECD list is almost empty. The FATF list is empty.

Luxembourg would not be a tax haven.

What about bankers that organise knowingly tax evasion that are not repudiated (it is not our duty to control if the taxpayer was honest) ? What about scams linked to exotic jurisdictions that are visible in the Corporate Registration (BVI, Seychelles, Panama...) : firms with exotic shareholder(s) and/or statutory auditor, with no economic reality (no address, no website, no staff... despite a commercial activity on the paper) ? Etc.

Nous souhaitons dans ce contexte un débat fructueux et constructif avec l’OCDE. Notre position, qui est une position de dialogue constructif, sera discutée avec le parlement luxembourgeois. (We wish in this context a profitable and constructive debate with OECD. Our position, which is a position of constructive dialog, will be discussed with the Luxembourg Parliament)

The experience of the implementation of recs relation to the Convention on Combating Bribery of Foreign Public Officials in International Business Transactions demonstrates that the "constructive debate" is for Luxembourg a delaying tactic while implementing quickly texts in favor of the business or being quickly in agreement to change the constitution. The jurisdiction is lax.

C’est à cet effet que je rencontrerai le secrétaire général de l’OCDE avant la fin de la semaine (It is for this purpose I will meet the general secretary of OECD before the weekend.)

Luc Frieden already met Angel Gurria in 2006 in Luxembourg and 2007 in Paris (the meeting in Paris was to discuss the Luxembourg positions in a certain number of questions where Luxembourg is the subject of critical observations, such as tax cooperation, harmful tax practices and fight against corruption).

Will the general secretary be given at this occasion a "generous grant" for the OECD like the FATF?

It seems that such grants from members, despite they are not a quoted funding, are accepted: the FATF and OCDE never answered my questions on the risks of such grants.

Additionally, as Angel Gurría, OECD Secretary-General, said (http://www.oecd.org/document/37/0,3343,en_2649_34487_39656933_1_1_1_1,00.html) in the framework of the ten-year anniversary of the adoption of the Convention on Combating Bribery of Foreign Public Officials in International Business Transactions: "It is one thing to enact laws, and another to enforce them".

I guess Angel Gurría will smell the coffee...

Le gouvernement, tout comme d’ailleurs le gouvernement précédent, reste prêt à adapter sa législation à la lumière des développements internationaux et des législations d’autres centres financiers pour améliorer la lutte contre les délits fiscaux. (The government, just like besides the previous government, remains ready to adapt its legislation in the light of international expansions and of the legislations of other financial centers to improve the fight against the tax offenses.)

A government does not make the legislation: it is the parliament. But in Luxembourg changes to the legislation are decided by the financial sector, which acts as the fourth estate that dominates the government, the parliament and the justice.

For example banking secrecy is not a tradition in Luxembourg. It was decided by bankers then validated later by the law.

06:53 Posted in Luxembourg | Permalink | Comments (1)

03/09/2009

The richest tax haven you are, the least you contribute to international institutions of control that failed

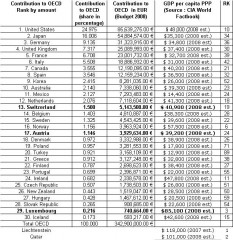

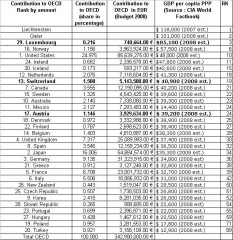

The OECD is funded by the member countries. National contributions to the annual budget are based on a formula related to the size of each member's economy.

Funding for the FATF is provided by its members on an annual basis and in accordance with the scale of contribution to the OECD. The cost of the secretariat and other services is met by the FATF budget, using the OECD as the channel for these operations. This scale is based on a formula related to the size of the country’s economy. Non-OECD members’ contributions are calculated using the same scale of OECD members. The two member organisations also make contributions to the FATF budget. Member grants like the one from Luxembourg are not quoted as a funding.

The contribution to the OECD and the FATF is not logical.

Luxembourg, the richest country among OECD members contributes with ... 0.216%

E.g. The OECD budget 2008 of 342,900,000.00 € is feed with the royal amount of 740,664.00 € by the richest country.

The following tables are telling :

Rank by Contribution share to the OECD in percentage

Rank by GDP

Switzerland, Austria and Luxembourg had a meeting yesterday in Luxembourg. Reuters has reported what said Luc Frieden, Luxembourg's Treasury and Budget Minister : "We think it is unacceptable that among our European and American friends, we have not had the possibility to have a debate together (...) We demand to be part of the discussions where the criteria for the list of so-called uncooperative countries will be fixed". Switzerland, Austria and Luxembourg want to be "integrated" into the debate on tax havens "to find ways to maintain banking secrecy while at the same time we are open to a dialogue on how to find ways to improve collaboration on tax offenses"

Luc Frieden :

demands be part of the Discussio.

says he is open to a dialogue.

It is not serious from the jurisdiction that does not care of international recs and has a lax business environment.

He wants to save time.

One year ago the OECD urged Luxembourg to introduce liability of legal persons for foreign bribery

The PR late March 2008 stated that "While the Working Group notes that Luxembourg has recently engaged in efforts to implement the Convention, it is seriously concerned that Luxembourg has not responded to some key recommendations issued by the Working Group since 2001. The Working Group has exceptionally decided to conduct a review of measures taken by Luxembourg to fulfill the recommendations of the Group again one year from now and reserves the right to take further steps in the event of continued failure to implement the Convention.

The report dated 20 March 2008 says page 4 that the Group is seriously concerned that Luxembourg has still not responded to key Phases 1 and 2 recommendations; these recommendations relate to the establishment of a clear, effective and dissuasive system of liability of legal persons and efforts to raise awareness of the foreign bribery offence among the private sector. Considering the seriousness of the situation, the Working Group has decided that, within one year, Luxembourg will report, in writing, on measures taken to fulfil the recommendations of the Group, and reserves the right, in the event of continued failure to implement the Convention, to take further steps.

Amendments to a draft law N°5718 were communicated in September 2008 at the Chambre des Députés : but the legislative procedure is frozen.

Liability of legal persons does not exist in the Luxembourg law and they will not be able to respect the OECD deadline at the end of the month.

It is actually easier in Luxembourg to change the constitution than to implement ethical international Recs as ethics does not exist in the jurisdiction that is money-driven with the fourth estate that is the financial institutions..

The OECD warned Luxembourg : the Working Group reserves the right, in the event of continued failure to implement the Convention, to take further steps.

Why not excluding Luxembourg from the OECD for the example?

The USA, Germany, France and the United Kingdom could make a pressure (threat of cutting their contribution) provided that they do themselves cleaning in the jurisdictions which depend on them, if not it would be neither fair with respect to the Mohicans of banking secrecy, nor credible.

But the critical question is the relevance of both the FATF and the OECD, that failed in their duty and have a responsibility because of their lax criteria to assess financial centers and lack of action.

They did not check if law and regulation were actually enforced and they did not sanction jurisdiction that did not implement their Recs.

Time is up to build a new international institution that will assess financial centers on pragmatic ethical criteria like those I had defined already two years ago.

18:08 Posted in Luxembourg | Permalink | Comments (0)