03/09/2009

The richest tax haven you are, the least you contribute to international institutions of control that failed

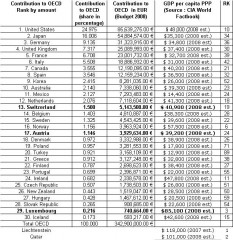

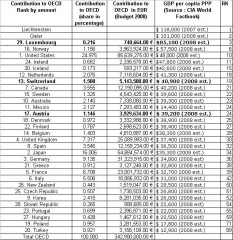

The OECD is funded by the member countries. National contributions to the annual budget are based on a formula related to the size of each member's economy.

Funding for the FATF is provided by its members on an annual basis and in accordance with the scale of contribution to the OECD. The cost of the secretariat and other services is met by the FATF budget, using the OECD as the channel for these operations. This scale is based on a formula related to the size of the country’s economy. Non-OECD members’ contributions are calculated using the same scale of OECD members. The two member organisations also make contributions to the FATF budget. Member grants like the one from Luxembourg are not quoted as a funding.

The contribution to the OECD and the FATF is not logical.

Luxembourg, the richest country among OECD members contributes with ... 0.216%

E.g. The OECD budget 2008 of 342,900,000.00 € is feed with the royal amount of 740,664.00 € by the richest country.

The following tables are telling :

Rank by Contribution share to the OECD in percentage

Rank by GDP

Switzerland, Austria and Luxembourg had a meeting yesterday in Luxembourg. Reuters has reported what said Luc Frieden, Luxembourg's Treasury and Budget Minister : "We think it is unacceptable that among our European and American friends, we have not had the possibility to have a debate together (...) We demand to be part of the discussions where the criteria for the list of so-called uncooperative countries will be fixed". Switzerland, Austria and Luxembourg want to be "integrated" into the debate on tax havens "to find ways to maintain banking secrecy while at the same time we are open to a dialogue on how to find ways to improve collaboration on tax offenses"

Luc Frieden :

demands be part of the Discussio.

says he is open to a dialogue.

It is not serious from the jurisdiction that does not care of international recs and has a lax business environment.

He wants to save time.

One year ago the OECD urged Luxembourg to introduce liability of legal persons for foreign bribery

The PR late March 2008 stated that "While the Working Group notes that Luxembourg has recently engaged in efforts to implement the Convention, it is seriously concerned that Luxembourg has not responded to some key recommendations issued by the Working Group since 2001. The Working Group has exceptionally decided to conduct a review of measures taken by Luxembourg to fulfill the recommendations of the Group again one year from now and reserves the right to take further steps in the event of continued failure to implement the Convention.

The report dated 20 March 2008 says page 4 that the Group is seriously concerned that Luxembourg has still not responded to key Phases 1 and 2 recommendations; these recommendations relate to the establishment of a clear, effective and dissuasive system of liability of legal persons and efforts to raise awareness of the foreign bribery offence among the private sector. Considering the seriousness of the situation, the Working Group has decided that, within one year, Luxembourg will report, in writing, on measures taken to fulfil the recommendations of the Group, and reserves the right, in the event of continued failure to implement the Convention, to take further steps.

Amendments to a draft law N°5718 were communicated in September 2008 at the Chambre des Députés : but the legislative procedure is frozen.

Liability of legal persons does not exist in the Luxembourg law and they will not be able to respect the OECD deadline at the end of the month.

It is actually easier in Luxembourg to change the constitution than to implement ethical international Recs as ethics does not exist in the jurisdiction that is money-driven with the fourth estate that is the financial institutions..

The OECD warned Luxembourg : the Working Group reserves the right, in the event of continued failure to implement the Convention, to take further steps.

Why not excluding Luxembourg from the OECD for the example?

The USA, Germany, France and the United Kingdom could make a pressure (threat of cutting their contribution) provided that they do themselves cleaning in the jurisdictions which depend on them, if not it would be neither fair with respect to the Mohicans of banking secrecy, nor credible.

But the critical question is the relevance of both the FATF and the OECD, that failed in their duty and have a responsibility because of their lax criteria to assess financial centers and lack of action.

They did not check if law and regulation were actually enforced and they did not sanction jurisdiction that did not implement their Recs.

Time is up to build a new international institution that will assess financial centers on pragmatic ethical criteria like those I had defined already two years ago.

18:08 Posted in Luxembourg | Permalink | Comments (0)

The comments are closed.