02/19/2009

KBL and La Mondiale Lose Bid to Get Madoff-Linked Funds

Bloomberg has reported that the Luxembourg justice decided that UBS AG doesn’t have to pay back KBL Richelieu and insurer La Mondiale about $4 million from an Access International Advisors LLC fund that had invested with Bernard Madoff.

The “extraordinary” situation shows how difficult it is for courts “to address the legitimate interest of the custodian” and “of investors who’ve suffered a loss,” said Damien Byrne Hill, a partner specializing in litigation for financial institutions at Herbert Smith in London, quoted by Bloomberg.

By the why what did state the ALFI before the EFAMA one month ago ? ALFI stated that "The first Luxembourg court ruling concerning the Madoff-Luxalpha affair (the ruling on the ODDO case) has shown that the Luxembourg courts are ready to make rapid, firm decisions in favour of investors". ALFI added "even though the legal basis in this specific case does not apply to all investors (ODDO had asked to redeem its shares before the fraud was uncovered)."

Bloomberg observes that KBL Richelieu, a French wealth-management company, and La Mondiale said they had made a redemption request on Nov. 14, almost a month before Madoff was charged with securities fraud.

As I said the legal and regulatory framework in Luxembourg is so confused because of what professionals call "pragmatism" (clear and pragmatic legal and regulatory framework) that there are uncertainties for investors in the lawsuits.

06:52 Posted in Luxembourg | Permalink | Comments (0)

02/17/2009

Hundreds of Icelandic Companies Registered in Tortola through Luxembourg

In an article a couple of months ago I underlined the risks in Luxembourg because of companies linked to exotic jurisdictions that are tolerated despite "red flags" in official sources.

Iceland Review yesterday published an interesting article that confirms that the Luxembourg jurisdiction may be used to commit frauds.

According to the newspaper such companies are first and foremost established to hide ownership patterns or funds and assets that were earned in a questionable manner.

Former Minister of Business Affairs Björgvin G. Sigurdsson stated that "One of the main things that must be done when this legal frame is reviewed, is to prevent such things from happening again".

06:47 Posted in Luxembourg | Permalink | Comments (0)

02/07/2009

The evidence of words and the standardized lie

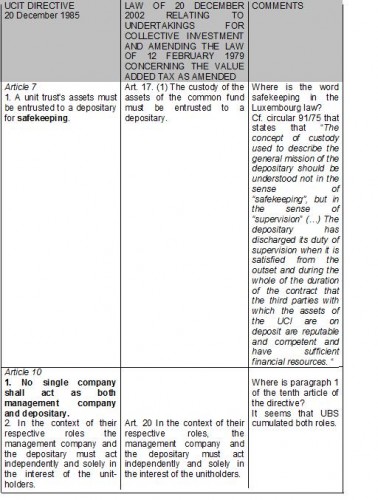

Whereas on the one hand the CSSF has just made a concise official statement announcing that it finished its investigations, and that it has agreed with UBS to "cooperate in their efforts to determine the relevant facts and define the way forward in close conjunction with all others who are affected by the events in order to find a solution as soon as possible" and on the other hand the official statements (Minister of Justice, CSSF, ALFI...) claim that the legal and regulatory framework in Luxembourg complies with the European directive, I am afraid that everyone in the business in Luxembourg is not telling the truth for something that is very easy to check with a synoptic table of the transposition.

Two critical provisions in the directive to protect the investors have been knowingly removed because of influences from the financial sector (lawyers, auditors, banks) like for any topic in the name of pragmatism.

The two paragraphs are the following.

The full synoptic table may be downloaded by clicking here.

As long as the leaders either politicians or professionals that do not tell the truth on things easy to check will not have been changed in the jurisdiction there will be an unquestionable risk for the investors.

The communication was and is pitiful : they did not make amend.

Those in place do not have anymore credibility.

08:13 Posted in Luxembourg | Permalink | Comments (0)