10/27/2009

The Luxembourg Monthly Finance Lunch: A business view on ethics in policies

According to LIGFI website, the Luxembourg Institute for Global Financial Integrity is launching “the first cycle of the Luxembourg Monthly Finance Lunch. The purpose of the lunch is twofold: (1) providing the opportunity of hearing a personality of authority and international recognition present his opinion on current issues affecting the global financial center; and, (2) serving as a venue at which people can meet and engage in dialogue.

The lunch is open to all. LIGFI hopes to attract participants from Luxembourg, its neighboring countries and beyond.

The first Keynote Speaker at the lunch, set for Wednesday 25th of November 2009, will be Luxembourg Finance Minister Luc Frieden who will start off the lunch cycle on the theme 'A political view on ethics in business.'”

I am very happy to see that professionals and politicians in Luxembourg demonstrate once more their close link in the jurisdiction where professionals have a close and direct say in the drawing up of laws and regulations that are enforced and fustigate thos who dare question (see reactions after the publication of Rainer Falk's study).

As I said, we have three Luxembourg politicians in the Board of Regents, that belong to the same political party that leads the jurisdiction for years.

The first Keynote Speaker at the lunch, set for Wednesday 25th of November 2009, will be Luxembourg Finance Minister Luc Frieden, who belongs to the same political party that leads the jurisdiction for years.

I am afraid Minister Frieden failed to implement ethical provisions that were required when he was Minister of Justice whereas the jurisdiction communicates that one on its quick decision-making process (see for example PwC Luxembourg brochure: "Why Luxembourg", page 39, and page 93 of a brochure that was published by the Luxembourg government in 1999, the year when Luc Frieden was reappointed Minister of Justice: "In Luxembourg direct contact with Cabinet members is a normal procedure. This produces quick and timely decisions. Avoiding over-regulation and excessive red tape has certainly prompted the emergence of Luxembourg as financial center in the nineteen sixties") and that was able to change the constitution in a couple of weeks.

“What we all are missing are facts, rather than the continuous outflow of innuendos, unsubstantiated attacks and emotional outbreaks”, an article posted recently by LIGFI said.

Let’s see two examples that are not exhaustive of the so-called “quick decision-making process” in areas related to ethics in business.

Criminal liability for legal persons

Criminal liability for legal persons is required both by the OECD Anti-Bribery Convention, which was signed on 17 December 1997 and came into force on 15 February 1999, and by many OECD reports (and GRECO reports) in the 2000s.

Parliamentary question Number 466 dated 3 April 2000 (Xavier BETTEL and Gusty GRAAS) was about the criminal liability of legal persons. Luc Frieden’s answer was the following : “ J'ai l'honneur de vous confirmer que le Luxembourg va légiférer en vue d'introduire le principe de la responsabilité pénale des personnes morales. Le groupe de travail "Réforme du droit des sociétés" est chargé d'élaborer le concept. » (free translation : I have the honor of assuring you that Luxembourg will legislate in order to introduce the principle of the criminal liability for legal persons. The work group “Reforms of business law” is charged to work out the concept”.

I love the idea that criminal liability for legal persons is a “concept” i.e. something conceived in the mind or an abstract or generic idea generalized from particular instances.

The Luxembourg government has filed on 20 April 2007 Bill number 5718. There are only 22 pages.

What is the status?

Nothing enforced and OECD is getting nervous:

- "OECD urges Luxembourg to introduce liability of legal persons for foreign bribery" (OECD Working Group on Bribery, 27 March 2008)

- "Toutefois, force est de constater que plus de deux ans se sont écoulés depuis le dépôt du projet de loi, sans que celui-ci n’ait encore franchi une étape décisive dans la procédure parlementaire. Le Groupe de travail de l’OCDE sur la corruption reste donc sérieusement préoccupé par l’absence de responsabilité des personnes morales en droit luxembourgeois, dix ans après l’entrée en vigueur de la Convention sur la lutte contre la corruption d’agents publics étrangers dans les transactions commerciales internationales. Cette situation constitue un manquement grave et continu aux obligations du Luxembourg par rapport à la Convention." (Mark Pieth-OECD Working Group on Bribery, 22 July 2009)

Mutual Assistance in Criminal Matters between the Member States of the European Union

The Luxembourg government has filed on 20 March 2009 the Bill N°6017 bearing

1. Approval of the Council Act of … 29 May 2000 establishing in accordance with Article 34 of the Treaty on European Union the Convention on Mutual Assistance in Criminal Matters between the Member States of the European Union.

2. Approval of the Council Act of ... 16 October 2001 establishing, in accordance with Article 34 of the Treaty on European Union, the Protocol to the Convention on Mutual Assistance in Criminal Matters between the Member States of the European Union

3. Change to certain provisions of the criminal Instruction code and the law of 8 August 2000 on Mutual Assistance in Criminal Matters

There are only 22 pages.

What is the status?

Sent to the “legal committee” (Commission juridique) twice: 16 April and 8 October.

Nothing enforced.

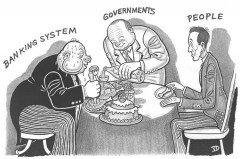

I am exaggerating when I state that in Luxembourg business view is over ethics in policies?

Definitely not.

I will quote again what the first Keynote Speaker said before the Association Luxembourgeoise des Professionnels du Patrimoine (ALPP).

Before the Association Luxembourgeoise des Professionnels du Patrimoine (ALPP), Luc Frieden confirmed the objective to sign 20 OECD-compliant tax agreements by the end of the year. But the stated good intention is broken by the last sentence of the last but one paragraph that quote the professionals: “We rely on you. Our clients believe in us. They are there because of banking secrecy.”

Why on earth are clients there because of banking secrecy? For tax evasion all the more than there will be no automatic information exchange.

One understands better the reason why Luxembourg is not in favor of automatic exchange.

Can they rely on Minister Frieden?

Yes they can. The answer was given two years ago before the same Association Luxembourgeoise des Professionnels du Patrimoine (ALPP):

« Est-ce qu'une grande place financière comme la nôtre doit exagérer un peu ou bien être plus laxiste au risque de laisser passer quelques scandales ? Oui, il peut arriver que nous ayons exagéré certaines procédures, mais c'était dans une tendance générale en Europe. J'espère que nous n'avons pas mal fait et qu'il est encore possible de revenir en arrière. Je ne veux surtout pas que l'on dise que nous ne faisons plus rien et je suis prêt à abandonner certaines exigences » (free translation: "Should a large financial center like ours exaggerate or be more lax with the risk of a couple of scandals. Yes we may have exaggerated some procedures but this was a general trend in Europe. I hope we have not done badly aand that it is still possible to go back. I am ready to give up some requirements"), Luc Frieden said.

In this context, the "level playing field" concept that was stated a couple of days ago (the European Union is a zone where rules differ from those applied outside, but given the volatility of capital and the free circulation of capital, we must take care that these rules do not work to the detriment of financial centres within the European Union) to block an agreement with Liechtenstein sounds like foot-dragging tactics. If the issue is actual, Luxembourg should have asked for measures to control the flows outside the European Union. Luxembourg and Austria had actually a selfish attitude as banking secrecy and limited exchange (that was accepted under pressure) favor tax evasion that is not repudiated.

A business view on ethics in policies rather than a political view on ethics in business, for the first lunch.

Quod erat Demonstrandum.

Happy lunch !!!!!

.

05:37 Posted in Luxembourg | Permalink | Comments (0)

10/24/2009

LIGFI snubs and disregards TJN and GFI

I have posted a couple of articles about LIGFI to observe it is an empty shell with a deceptive goal that was launched in a jurisdiction:

- where critics are repudiated (Cf. censorship of a report after pressure and threats),

- where regulation is perfectible because of the conflicts of interests and the direct say of professionals in the drawing up of laws and regulations that are applicable to them, which is practically an assent,

It is amazing to observe that 3 members out of 4 of the board of regents are both Luxembourgish and politicians (Jean-Claude Juncker, Jacques Santer and Lucien Thiel). The last member is Swiss.

LIGFI remains an empty shell despite the first articles are online on its website.

“What we all are missing are facts, rather than the continuous outflow of innuendos, unsubstantiated attacks and emotional outbreaks”, an article posted this week says.

Let’s see facts just on the LIGFI website to analyse the culture behind the project:

The “Publications” page starts with these words: The Luxembourg Institute for Global Financial Integrity will post publications that it deems of particular interest and significance in the support and promotion of professional excellence, ethics and integrity in the global financial sector.

And they list :

CFA Institute

The CFA Institute Centre for Market Integrity published so far in 2009 six Financial Market Integrity Index Surveys on the United States, Canada, the United Kingdom, Switzerland, Japan and Hong Kong. On a scale of one (not ethical at all) to five (very ethical), the United States is scored in the 2 range for “slightly ethical” and the other countries typically at or around 3 for “somewhat” ethical.

http://www.cfapubs.org/loi/ccb

Transparency International

Transparency International published 2009 updates to its Global Corruption Barometer (GCB), Corruption Perceptions Index (CPI) and Briber Payers Index (BPI). All three documents paint an unsatisfactory picture of the levels of corruption that prevail around the world.

http://www.transparency.org/policy_research/surveys_indices/gcb

http://www.transparency.org/policy_research/surveys_indices/cpi

http://www.transparency.org/policy_research/surveys_indices/bpi

Global Witness

Global Witness published in 2009 its study “Undue Diligence: How banks do business with corrupt regimes” that highlights corrupt funds finding their way into the global financial system and the lack of resolve of certain banks to address compliance in dealing with the sources of such funds given the lack or ambiguity of regulation and law.

http://www.globalwitness.org/media_library_detail.php/735/en/undue_diligence_how_banks_do_business_with_corrupt

Financial Stability Board (FSB)

The Financial Stability Board, whose Charter was endorsed by the G20 at the September 2009 Pittsburgh meeting, has published in September 2009 three recent reports on “Improving Financial Regulation”, “Overview of Progress in Implementing, the London Summit Recommendations for Strengthening Financial Stability”, and “FSB Principles for Sound Compensation Practices”. The reports are a forewarning to the regulatory and oversight environment that banking and other financial services worldwide can expect over the coming months and years. They capture the political will expressed by the G20 to firmly address the issues of financial behavior and systemic risk that are the root cause of the current financial and economic crises. http://www.financialstabilityboard.org/

Comments

1. They use an interesting report from the CFA Institute but in a biased perspective as the study focuses on big jurisdictions whereas many issues relating to money laundering tax evasion and/or fraud in a general rule are in small jurisdictions.

2. LIGFI write that Transparency International published 2009 updates to its Global Corruption Barometer (GCB), Corruption Perceptions Index (CPI) and Briber Payers Index (BPI). They ignore that the CPI no longer exists as I explained.

3. To be honest, they quote Global Witness that published a report that is critical for Luxembourg.

4. Finally, the Financial Stability Board, which is successor to the Financial Stability Forum, was established in April 2009 following the 2009 G-20. It comprises senior representatives of national financial authorities (central banks, regulatory and supervisory authorities and ministries of finance), international financial institutions, standard setting bodies, and committees of central bank experts. It is therefore vulnerable to “political games” like the OECD.

But above all, three major actors in the debate are missing in the list:

Global Financial Integrity. As the LIGFI team members live in the bowl they did not know that a body with similar title already exist since September 2006. Global Financial Integrity promotes national and multilateral policies, safeguards, and agreements aimed at curtailing the cross-border flow of illegal money. In putting forward solutions, facilitating strategic partnerships, and conducting groundbreaking research, GFI is leading the way in efforts to curtail illicit financial flows and enhance global development and security. This body has just completed a conference on “Increasing Transparency in Global Finance: A Development Imperative”.

Tax Justice Network promotes transparency in international finance and opposes secrecy. We support a level playing field on tax and we oppose loopholes and distortions in tax and regulation, and the abuses that flow from them. They promote tax compliance and they oppose tax evasion, tax avoidance, and all the mechanisms that enable owners and controllers of wealth to escape their responsibilities to the societies on which they and their wealth depend. Tax havens, or secrecy jurisdictions as we prefer to call them, lie at the centre of their concerns, and they oppose them. They just launched their website for the Mapping the Faultlines project (see www.secrecyjurisdictions.com), which explores the furtive world of secrecy jurisdictions where furtive types get up to all sorts of dubious business and another website (see www.financialsecrecyindex.com) which takes reader step-by-step into the details of their new ranking of secrecy jurisdictions. The ranking results will be published early November.

The Task Force on Financial Integrity and Economic Development is a consortium of Governments and NGOs that focuses on achieving greater transparency in the global financial system for the benefit of developing countries. It addresses the inequalities in the global financial system that penalize billions of people, and will advocate for greatly improved transparency and accountability

In a nutshell, according to LIGFI none of the above powerhouses in the debate - that proved reliable contrary to LIGFI - deems of particular interest and significance in the support and promotion of professional excellence, ethics and integrity in the global financial sector.

16:08 Posted in Luxembourg | Permalink | Comments (0)

10/22/2009

Games theory with Luxembourg

Yesterday I quoted European Tax Commissioner Laszlo Kovacs who said that the actions of Austria and Luxembourg were hampering progress in cracking down on global tax fraud, an issue he said was “high on the political agenda of the EU.

The question is: what is to be done to achieve the goal of automatic exchange?

I have an idea: the services of clearing house are done in Luxembourg by Clearstream. Clearstream International was formed in January 2000 through the merger of Cedel International and Deutsche Börse Clearing.

I suggest that EU governements encourage their banks to chose another clearing house for the clearing services, in a jurisdiction that play the truth and fair competition game.

05:49 Posted in Luxembourg | Permalink | Comments (0)