08/03/2009

Regulators: France v. Luxembourg

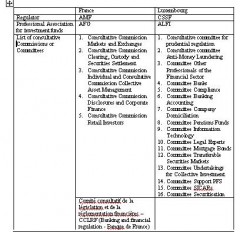

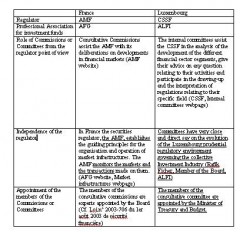

In the context of the debate on the depositary, let’s compare the regulators in France and in Luxembourg on a couple of telling criteria.

Comment

There are much more committees/commissions in Luxembourg than in France but none for the clients. The members of these Committees represent the companies subject to the prudential supervision of the CSSF, professional associations representing the various segments of the financial sector as well as external auditors and legal advisers active in the financial field. Clients are not represented in the numerous committees in Luxembourg whereas clients are represented in the retail Investors Commission in France.

The internal committees in Luxembourg are tailored for the financial sector to have very close and direct say on the evolution of the Luxembourg prudential regulatory environment. The regulation in Luxembourg is practically subordinate to professionals in the framework of the numerous committees whereas in France the regulator, establishes the guiding principles for the organisation and operation of market infrastructures and monitors the markets and the transactions made on them.

Sources:

France

AMF : Consultative Commissions and Specialised Commissions

AFG: Relationships with the regulator

Luxembourg

CSSF: Consultative committees

ALFI : Relationships with the regulator

08:51 Posted in Comparison | Permalink | Comments (0)

08/02/2009

The Luxembourg professionals white list

I have noticed with great satisfaction that my blogs about the Luxembourg financial center got great attention in many places, and at the same time I'm disappointed that only in Luxembourg they are often misread as being "negative". I certainly disagree with some of the common understandings among professionals there, and I wondered who could be those who are open minded enough to have a look at the arguments instead of the messenger, and see them as "positive" contributions.

I believe that those who were willing to pick up directly on the discussion about what I consider to be dangerous shortcomings, will be the most likely to have a serious second look at the issues. They are the most likely to be able to salvage the center's reputation, when they realize later that the way to defend the financial center is not by hushing up issues, but on the contrary by tightening up the ship. I only hope it will not be too late.

I'll review those leaders, the points of disagreements and possible remedies by starting a list of the prominent hope bearers: the Luxembourg professionals white list.

Let's start with jean Meyer.

Jean Meyer chairs the ABBL (the Luxembourg Bankers’ Association).

He is aware that the financial center depends on the head offices where the decision making power is. He stated on 25 April 2006, one month before the release of my book (Vus... Pas pris! Paris, Le Publieur), that "les acteurs financiers luxembourgeois appartiennent pour leur très grande majorité à des grands groupes financiers internationaux. Ils doivent se battre, au jour le jour, au sein de leur groupe pour drainer et attirer de nouvelles affaires vers le Luxembourg. Et pour chaque nouvelle transaction, ils sont en concurrence avec d’autres entités du groupe." (free translation: the Luxembourg financial actors belong for their very large majority to large international financial groups. They must fight, from day to day, within their group to drain and attract new business towards Luxembourg. And for each new transaction, they are in competition with other entities of the group).

With the conflicts of interest that are unfortunately standard in the Luxembourg regulation because of the actors’ very close and direct say on the evolution of the Luxembourg prudential regulatory environment governing the collective Investment Industry, Jean Meyer as a smart lawyer cannot ignore the consequences of changes to the language of European directives: words added or removed under the influence of professionals may modify the enforcement European directives or other international texts and denature their objectives.

The consequence is that Luxembourg is currently a risk for the brands of international financial groups as the Luxembourg prudential regulatory environment is in question. The UBS-Luxalpha affair is revelatory of a regulatory subordination to professionals that influence the regulator in its duties (they participate in the drawing-up and the interpretation of regulations relating to their specific field) to the point that regulation failed.

19:03 Posted in Luxembourg | Permalink | Comments (0)

08/01/2009

Better late than never

A couple of weeks ago in an article I underlined a telling censorship on the depositary issue in the Alfi News Digest that was published on 13 July 2009 for July 2009.

The Alfi News Digest for July-August 2009 was published on 28 July 2009

There is a very good summary of the consultation on the depositary issue:

EC : public consultation on the UCITS depositary function

Against the background of recent discussions on the legislative framework for UCITS depositaries, the European Commission has launched a wide-ranging public consultation in terms of depositary’s duties, responsibility regime, organisational requirements, eligible criteria and supervision. The consultation also covers issues which are not directly linked with depositaries duties but which are particularly relevant for ensuring an increased level of investor protection within the UCITS framework (for example valuation).

The consultation is available at: http://ec.europa.eu/internal_market/investment/depositary_en.htm

The deadline for responses to this consultation paper is 15 September 2009.

Responses should be addressed to: market-depositary-consultation@ec.europa.eu

Maybe the ALFI contribution to this public consultation will be prepared by Rafik Fischer, currently member of the Board.

He is responsible for the depositary bank issues among ALFI’s vital issues.

He is the one who admitted the influence of the ALFI on the regulator in 2005 "The Luxembourg Investment Fund Industry has regularly had a very close and direct say on the evolution of the Luxembourg prudential regulatory environment governing the collective Investment Industry. (...) This influence has been exerted directly and indirectly by the lobbying initiatives taken on the level of the different professional associations, be it ALFI or ABBL, but also and more importantly, trough a direct association with the Luxembourg Supervisory Authorities by means of a number of standing committees”

He can be found for many years on the board of Directors of the CSSF, in the Prudential regulation consultative committee, in the Pension funds committee, in the Undertakings for collective investment committee, where he regularly had a very close and direct say on the evolution of the Luxembourg prudential regulatory in the name of the ALFI.

See for example Annual Report 2008.

Such influence on the regulator in not acceptable.

Unless one finds it normal that

- Audited should have a very close and direct say on their auditor’s methods and duties

- Tax payers should have a very close and direct say on the tax administration’s methods and duties

- Students should have a very close and direct say on their professor’s methods and duties

- Subordinates should have a very close and direct say on their management’s methods and duties

- etc

20:02 Posted in Luxembourg | Permalink | Comments (0)