07/05/2009

Organisational requirements: the Luxembourg fallacious transposition and communication

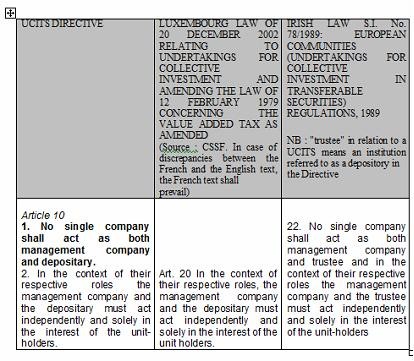

The working paper observes that “on the rules applicable to conflicts of interest, the amended UCITS Directive only sets principles of separation and ethical independence between the fund manager and the depositary in particular, Article 25 of the amended 85/611/EEC UCITS Directive - which reproduces the existing Article 10 of Directive 85/611/EEC – provides that: ‘no single company shall act as both Management Company and depositary (…) in the context of their respective roles the management company and the depositary shall act independently and solely in the interest of the unit-holders’. Depositaries may face situations where they can no longer ensure that they act solely and exclusively in the interest of unit-holders.”

The so-called clear and pragmatic rules in Luxembourg do not require that no single company shall act as both Management Company and depositary.

NB: In French documents Custodian is translated by Depositary.

The Requirement to prevent conflicts of interest, and especially the one of Management Company and Depositary that is explicitly stated in the UCITS Directive, was definitely dropped in Luxembourg despite a communication on the faithful transposition of the UCITS directive

19:58 Posted in General | Permalink | Comments (0)

Responsibility regime: the Luxembourg fallacious transposition and communication

As Luc Frieden stated in 2004, "Based on clear and pragmatic legal rules that are fully compliant with the EU legal framework as well as on the unique international experience built up over the past decades, the Grand-Duchy of Luxembourg will continue to undertake every effort to develop Luxembourg as the European hub for investment funds both for European and non-EU financial operators." Cf. article « The art of Communication », Fundlook, July-September 2004, page 3)

We have seen that the fully compliance with the EU legal framework is a charade for the depositary duties.

What about the Responsibility regime?

Investors may face a risk associated to the depositary function not only if the depositary fails to perform its duties ('improper performance') and if the depositary defaults, as it is stated in the working paper, but as well at the beginning if a requirement is not enforced so that the set of relating duties cannot exit, what could be called ‘performance denial’.

In the Luxembourg situation, the safe keeping duty was dropped in the law, so that there cannot be any performance in the scope of the safekeeping requirement.

As far as the delegation to a third party is concerned, what is stated in the Luxembourg law is worth reading (click on the table):

It is interesting to see that the Luxembourg law of 2002 does not refer to the article relating to the depositary’s liability when assets are entrusted to a third party. The Irish law does. The Luxembourg law of 2002 admits the custody duty where the directive and the Irish law use the word safekeeping.

Additionally, what is stated in the Luxembourg Circular AML 91/75 demonstrate the lack of responsibility of those - lawyers and other professionals - that formulate the way the depositary may discharge its duty of supervision: when it is satisfied from the outset and during the whole of the duration of the contract that the third parties with which the assets of the UCI are on deposit are reputable and competent and have sufficient financial resources.

This is not compatible with the supervision duties as stated in the directive and as recalled in the working paper:

Article 22 of the UCITS Directive stipulates that a "Depositary shall:

- ensure that the sale, issue, re-purchase, redemption and cancellation of units effected on behalf of a common fund or by a management company are carried out in accordance with the law and the fund rules;

- ensure that the value of units is calculated in accordance with the law and the fund rules;

- carry out the instructions of the management company, unless they conflict with the law or the fund rules;

- ensure that in transactions involving a common fund's assets any consideration is remitted to it within the usual time limits;

- ensure that a common fund's income is applied in accordance with the law and the fund rules."

Luxembourg was not allowed to discharge the depositary’ liability to a third party as it is stated in the so called legal and regulatory framework that is not the faithful transposition of the UCITS directive.

15:06 Posted in General | Permalink | Comments (0)

07/04/2009

Depositary’s duties – safekeeping and Supervisory duties: the Luxembourg fallacious transposition and communication

The European Commission yesterday circulated a consultation paper on the UCITS depositary function.

The document formulates 31 questions that are divided into sections:

- Depositary’s duties – safekeeping duties (questions 1 to 5)

- Depositary’s duties – Supervisory duties (questions 6 to 9

- Responsibility regime – Liability regime in case of improper performance (questions 10 to 14)

- Responsibility regime – Liability regime in case of delegation (questions 15 to 17)

- Responsibility regime – Default (bankruptcy) (questions 18 to 19)

- Organisational requirements (questions 20 to 23)

- Eligible depositary institutions (questions 24 to 26)

- Supervision issues – Supervision by auditors (question 27)

- Supervision issues – Supervision by national regulators (questions 28 to 29)

- Other investors protection issues (questions 30 to 31)

In the next days I would like to comment every section.

I will begin today with the Depositary’s duties – safekeeping and Supervisory duties sections.

The development on the safekeeping duties in the working paper observes that “According to Article 22 of the amended UCITS Directive : “a common fund’s assets must be entrusted to a depositary for safe-keeping”. The UCITS Directive does not define the meaning of “safe-keeping”. At national level, approaches differ as to what exactly a depositary is expected to do when it is entrusted with the task of safe-keeping the funds assets.”

I am afraid the analysis prior to the questions does not tighten up the ship.

As far as the Luxembourg (you know, the jurisdiction that transposed faithfully the UCITS directive) legal and regulatory framework is concerned, it is not a question of divergence of interpretation, but a question of knowingly fallacious transposition.

What was enforced in Luxembourg does not comply with the directive: in the implementation of the UCITS directive, Luxembourg clever pragmatic lawyers and professionals removed the safekeeping duties to only state limited supervisory duties, while the UCITS Directive is clearly stating both duties : safekeeping and supervisory duties.

Why was the word “safekeeping” removed in the law of transposition (Cf. article 17 of the Luxembourg Law of 20 December 2002) as is in one of the depositary’s duties stated clearly in article 7 of the directive?

What Circular AML 91/75 states emphasizes the issue: The concept of custody used to describe the general mission of the depositary should be understood not in the sense of “safekeeping”, but in the sense of “supervision” as it confirms the drop of the duties of safekeeping.

The working paper observes that The UCITS Directive does not define the meaning of “safe-keeping”. If the UCITS directive doesn’t, the dictionary does. So it defines the meaning of "supervision".

What circular AML 91/75 states about the supervision (“The depositary has discharged its duty of supervision when it is satisfied from the outset and during the whole of the duration of the contract that the third parties with which the assets of the UCI are on deposit are reputable and competent and have sufficient financial resources“) is not an efficient supervision as it cannot ensure a critical watching and directing.

As far as the word safekeeping is concerned, the dictionary states:

1 : the act or process of preserving in safety

2 : the state of being preserved in safety

Preserve means:

1: to keep safe from injury, harm, or destruction : protect

2 a: to keep alive, intact, or free from decay b: maintain

3 a: to keep or save from decomposition b: to can, pickle, or similarly prepare for future use

4: to keep up and reserve for personal or special use

Keep means:

(…)

4 a: to retain in one's possession or power <kept the money we found> b: to refrain from granting, giving, or allowing <kept the news back> c: to have in control <keep your temper>

(…)

The meaning of "safekeeping" is therefore clear enough and Luxembourg was not allowed to change the duties.

In a nutshell, Luxembourg with its pragmatic lawyers and professionals not only dropped the duties of safekeeping that was clearly stated in the directive but formulated the duties of supervision in a way that did not comply with the common meaning of the word supervision.

That is the reason why the communication about the “faithful transposition” of the directive (see what stated the ALFI before the EFAMA late January 2009) is not acceptable as it is a huge breach in the confidence in UCITS funds so is the recent EFAMA support to the jurisdiction.

13:47 Posted in General | Permalink | Comments (0)