06/30/2009

Letter to Commissioner McCreevy

I wrote yesterday an article to explain why it is not very probable that the light is made on the responsibility for the depositary within the framework of the EFAMA.

I took again these arguments to send the following mail to Commissioner McCreevy:

Dear Mr McCreevy

Further to Niall Bohan’s answer on your behalf last 20 March 2009 (Cf. my query dated 13 February on "The UCITS Directive and its transposition in Luxembourg and Ireland in the context of the Madoff case"), I would like to share with you my views on the way the EFAMA is handling the issue, which is worrying for the credibility of the UCITS.

The reading of the EFAMA annual report 2008-2009 (pdf file created on 16 June 2009 and modified on 17 June 2009) allows to concluding that it does not seem aware of the stake of the truth on the depositary’s liability.

There is a development about the depositary’s liability, which wants commenting (pages 18 and 19):

1. Your conclusion dated 28 May (the minimum high level principles of the UCITS Directive have been transposed in very diverging ways by Member States. The outcome is an unlevel playing field. This means that some EU investors in UCITS funds are better protected than others) (Source: Midday Express EXME09 / 28.05) is ignored. This opinion was however known when the EFAMA report was written and should have been taken into account.

2. The CSSF statement dated 27 May (As the CSSF has previously noted, UBSL shall have to indemnify a UCI depositor according to its obligations as a Luxembourg depositary bank, subject to valid and opposable contractual clauses to the contrary and, as the case may be, to a court decision in such matter) is ignored. This press release that made investors upset was however known when the EFAMA report was written and should have been taken into account.

3. The EFAMA bet that the European commission will do nothing: it states in its report that “signals seem to indicate that the Commission itself is not keen to “tighten up” the rules in the UCITS Directive regarding the responsibility of the depositary for safekeeping and the conditions for delegation of custody and would prefer to resort to other means rather than re-opening the Directive to achieve clarification on these issues.”

4. Above all, the EFAMA admits that it wants to hush up the issue of the transposition of the UCITS directive in Luxembourg in a manner that opened the drift. In other words the EFAMA does not want to tighten up the ship and sanction failures.

The EFAMA states that its “position in this discussion has been very clear from the beginning: contribute to making the discussion more objective and to putting an end to reciprocal incrimination, meet the concerned competent authorities to hear about the progress of their research and to remind them that the issue is urgent as the UCITS brand and investors’ trust are at risk, underline that investor protection remains EFAMA’s top priority, draw attention to the fact that the mechanism of the UCITS Directive provides for a high level of investor protection and that it is not yet clear that any investor in a UCITS will lose money, support the Commission in its view that a fundamental analysis is needed before discussing new or additional legislation.”

“Contribute to making the discussion more objective and to putting an end to reciprocal incrimination” is its first goal and is more important than “investor protection”, which is in third position. As far as competent authorities are concerned, the Luxembourg regulator (the CSSF) was disappointing: it did not sanction UBS (there would have been a sanction in any seriously regulated jurisdiction), and should have been any sanction, the amount would have been anyway ridiculous compared to what is done in any seriously regulated jurisdiction. This was admitted by the former head of the CSSF who just retired (See Paperjam, 20 mars 2009: http://www.paperjam.lu/archives/2009/03/2003_schaus/index... )

The appointment of Claude Kremer, chairman of the the ALFI (the official representative body for the Luxembourg investment fund industry) as EFAMA Vice-President makes difficult even impossible the principle of calling into question in the framework of the EFAMA the Luxembourg legal and regulatory framework.

I am afraid that investors and the European Commission cannot rely on the EFAMA, which seems much more business-oriented than client-oriented.

Two relevant questions should actually be answered:

Who (individual and/or legal person) introduced Madoff in Luxembourg (Europe)?

Probably someone that has/had an office in New York and that condoned red flags (See Greg N. Gregoriou and François-Serge Lhabitant, Madoff: A Riot of Red Flags. EDHEC, 16 February 2009).

Who (individual and/or legal person) support (in an opinion, in a committee…) the remove of two critical provisions of the Directive in the Luxembourg law of transposition, which opened the drift?

As I said, there are actually two critical provisions that are clearly missing in the Luxembourg text but that can be found in the Irish text or the French text:

- On the one hand, article 7 of the UCITS directive that states that “1. A unit trust's assets must be entrusted to a depositary for safekeeping”. The word “safekeeping” (that is missing is the French version of the article) was removed in the transposition (Cf. article 17 of the Luxembourg Law of 20 December 2002). Additionally, Circular IMS 91/75 (as amended by Circular CSSF 05/177) dated 21 January 1991 states that “The concept of custody used to describe the general mission of the depositary should be understood not in the sense of “safekeeping”, but in the sense of “supervision” (…) The depositary has discharged its duty of supervision when it is satisfied from the outset and during the whole of the duration of the contract that the third parties with which the assets of the UCI are on deposit are reputable and competent and have sufficient financial resources.“ Madoff was reputable and competent and had sufficient financial resources.

- On the other hand, Article 10 of the UCIT directive that states that “ 1. No single company shall act as both management company and depositary”. This provision is not in the Luxembourg text. This first paragraph was removed to only transpose literally paragraph 2 that states that “2. In the context of their respective roles the management company and the depositary must act independently and solely in the interest of the unit-holders.” (Cf. article 20 of the Luxembourg law of 20 December 2002). What is not clearly prohibited by the law is possible and it seems that UBS acted both as Management Company and depositary.

The European Commission has just referred Luxembourg to the European Court of Justice over its incorrect application of the Savings Directive. In my opinion, the European Commission should refer as well Luxembourg to the European Court of Justice over its incorrect application of certain provisions of the UCITS directive. There must be no tolerance for those so-called pragmatic professionals that caused prejudice to investors, and put the European fund industry at risk by harming its credibility.

Best regards.

Jérôme Turquey

Consultant in Business Ethics and Reputational Risk

http://ethiquedesplaces.blogspirit.com

08:40 Posted in General | Permalink | Comments (0)

06/29/2009

EFAMA is not aware of the stake in the truth on the depositary’s liability

Yesterday I wrote an article about the appointment of Claude Kremer from ALFI as Vice-President of the European Fund and Asset Management Association (EFAMA), which is not of good omen in my opinion for the investors’ protection, as this appointment may mean that EFAMA supports Luxembourg’s view on the depositary’s liability and definitely disregards demonstrated failures in the transposition of the UCITS Directive in Luxembourg.

I had confirmation by reading the EFAMA annual report 2008-2009 (pdf file created on 16 June 2009 and modified on 17 June 2009).

There is a development about the depositary’s liability, which wants commenting (pages 18 and 19):

1. Commissioner McCreevy’ conclusion dated 28 May (the minimum high level principles of the UCITS Directive have been transposed in very diverging ways by Member States. The outcome is an unlevel playing field. This means that some EU investors in UCITS funds are better protected than others) is ignored. This opinion was however known when the EFAMA report was written and should have been taken into account.

2. The CSSF statement dated 27 May (As the CSSF has previously noted, UBSL shall have to indemnify a UCI depositor according to its obligations as a Luxembourg depositary bank, subject to valid and opposable contractual clauses to the contrary and, as the case may be, to a court decision in such matter) is ignored. This press release was however known when the EFAMA report was written and should have been taken into account.

3. The EFAMA bets that the European Commission will do nothing: it states in its report that “signals seem to indicate that the Commission itself is not keen to “tighten up” the rules in the UCITS Directive regarding the responsibility of the depositary for safekeeping and the conditions for delegation of custody and would prefer to resort to other means rather than re-opening the Directive to achieve clarification on these issues.”

4. The EFAMA admits that it wants to hush up the issue of the transposition of the UCITS directive in Luxembourg in a manner that opened the drift. In other words the EFAMA does not want to tighten up the ship and sanction.

The EFAMA states that its “position in this discussion has been very clear from the beginning: contribute to making the discussion more objective and to putting an end to reciprocal incrimination, meet the concerned competent authorities to hear about the progress of their research and to remind them that the issue is urgent as the UCITS brand and investors’ trust are at risk, underline that investor protection remains EFAMA’s top priority, draw attention to the fact that the mechanism of the UCITS Directive provides for a high level of investor protection and that it is not yet clear that any investor in a UCITS will lose money, support the Commission in its view that a fundamental analysis is needed before discussing new or additional legislation.”

“Contribute to making the discussion more objective and to putting an end to reciprocal incrimination” is its first goal and is more important than “investor protection”, which is in third position. As far as competent authorities are concerned, the Luxembourg regulator, the CSSF, was disappointing: it did not sanction UBS (there would have been a sanction in any seriously regulated jurisdiction), and should there have been any sanction, the amount would have been anyway ridiculous compared to any seriously regulated jurisdiction

This was admitted by the former head of the CSSF who just retired.

The appointment of Claude Kremer as Vice-President makes difficult even impossible the principle of calling into question in the framework of the EFAMA the Luxembourg legal and regulatory framework.

Two relevant questions should actually be answered to “make the discussion more objective”:

Who (individual and/or legal person) support (in an opinion, in a committee…) the remove of two critical provisions of the Directive in the Luxembourg law of transposition which opened the drift

There are actually two critical provisions that are missing in the Luxembourg text but that can be found in the Irish text.

1)

Article 7 of the UCITS directive states that “1. A unit trust's assets must be entrusted to a depositary for safekeeping”. The word “safekeeping” (that is missing is the French version of the article) was removed in the transposition (Cf. article 17 of the Luxembourg Law of 20 December 2002). Additionally, Circular IMS 91/75 (as amended by Circular CSSF 05/177) dated 21 January 1991 states that “The concept of custody used to describe the general mission of the depositary should be understood not in the sense of “safekeeping”, but in the sense of “supervision” (…) The depositary has discharged its duty of supervision when it is satisfied from the outset and during the whole of the duration of the contract that the third parties with which the assets of the UCI are on deposit are reputable and competent and have sufficient financial resources.“

Madoff was reputable and competent and had sufficient financial resources.

2)

Article 10 of the UCIT directive states that “ 1. No single company shall act as both management company and depositary”. This provision is not in the Luxembourg text. This first paragraph was removed to only transpose literally paragraph 2 that states that “2. In the context of their respective roles the management company and the depositary must act independently and solely in the interest of the unit-holders.” (Cf. article 20 of the Luxembourg law of 20 December 2002).

What is not clearly prohibited by the law is possible and it seems that UBS acted both as Management Company and depositary.

Who (individual and/or legal person) introduced Madoff in Luxembourg?

Probably someone that has an office in New York and that condoned red flags.

There must be no tolerance for those so-called pragmatic professionals that caused prejudice to investors, and put the European fund industry at risk by harming its reputation.

There must be no tolerance for those so-called pragmatic professionals that caused prejudice to investors, and put the European fund industry at risk by harming its reputation.

I am afraid investors cannot rely on the EFAMA, which seems much more business-oriented than client-oriented, by refusing

- To admit that the European UCITS password from Luxembourg is corrupted i.e. is altered from the original version of the Directive and

- To support the relevant actions to be done.

14:25 Posted in Luxembourg | Permalink | Comments (0)

06/28/2009

Luxembourg: the slow-witted EU jurisdiction in the fight against corruption (update)

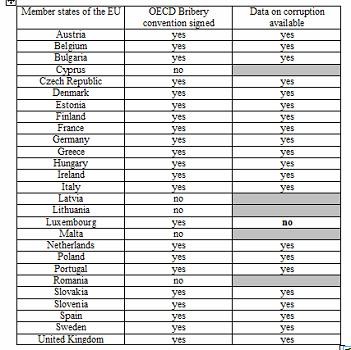

TI has just published a report on the enforcement of the OECD Bribery Convention.

In the report it is stated page 7 that “No TI reports were prepared for three countries, Estonia, Iceland and Luxembourg, since TI lacks experts in those countries, but TI Estonia provided current data on cases and investigations”.

It appears that in the tables data are actually missing only for two jurisdictions: Iceland, the jurisdiction that went bankrupt, and Luxembourg.

As far as Iceland is concerned, the jurisdiction is not an EU Member State. It has just hired Judge Eva Joly to tighten up the ship on the economic collapse and related crimes. There is no doubt that thanks to this powerhouse in the fight against corruption, the jurisdiction will be able to provide data in the future. But Eva Joly faces problems and said she would quit unless radical changes are implemented to prevent conflicts of interest and provide relevant means.

As far as Luxembourg is concerned, to begin with it is interesting to observe that the TI report confirms the relevance of my comparison Luxembourg v. Switzerland in favour of Switzerland as Switzerland is very well ranked in the enforcement of the OECD convention.

Additionally, among the EU Member States that signed the OECD convention (most States) Luxembourg distinguishes itself, as it is the only jurisdiction that is unable to provide data, which is telling for a jurisdiction that is an important financial center despite it is a tiny state.

As I explained, because of its small size, there are many conflicts of interest that may turn de facto into objective corruption situations without money paid, what is called the "system".

Networks

There are many associations in Luxembourg, but the center is very small so everybody meets in the same associations and when there is an issue involving a member a couple of phone calls to fellow member may help to hush up the issue. Everybody in the network knows the issue but there is no need to repudiate the bad professional that is supported by the group. To consolidate the support fellow members may knowingly join a board with the member in question. The problem in Luxembourg is that it is visible because of the small size, which is not the case in a bigger country where the bad professional may move up to another state to join the same kind of association but with new fellow members.

Intimidation

This situation is met when people do not do their duty because they fear for their job. This is particularly verified

- for internal auditors and compliance officers because of the subordination in the framework of the employment contract,

- for external auditors because of the business contract especially in a country where the leader of audit focuses on its growth and clients' confidence (not stakeholders'), which is not compatible with international professional provisions relating to audit ethics. This situation may explain the reason why there are so few declarations of suspicion (only 4) from auditors, which was considered suspect by the CRF, the Luxembourg FIU (Cf. for example Report 2003-2004, page 8 , were the number of 3 (close to 4) was said "ridiculously low for a profession composed of 304 members individual and having access to all the financial information of the center")

Fame

This last type of situation is met when people may hesitate to do or do not at all do their duty because they do not want to involve people that gain a professional standing because of professional, political or academic supports (in a board, in an association...). In other word, the will is to protect the frontage of the reputation of the center and its professional in any case. This is particularly verified

- for the media that have a public financing and globally do not have the culture to criticise the "system" and to tighten up the ship (even though there are exceptions),

- for justice, that lacks means (Cf. report "Petita Pro Nova Justitia" issued by the Cercle Joseph Bech), a perfect illustration of this problem being the delay to judge sensitive affairs and the absence of judgements database.

The decision of the CSSF on UBS about Madoff is perfect illustration of how the "system" works with a wrong perception of the stake as the case is not internal.

Management of UBS/Luxalpha were close to Management of the CSSF, in CSSF Committees for example.

The CSSF did not sanction UBS where there would have been a sanction in any other jurisdiction.

I do not think that Luxembourg, where the criminal liability for legal persons does not exist despite an injunction last year by the OECD, may be credible with the launch of the LIGFI to promote worldwide stronger ethical practices and standards based on the principles of integrity: transparency, fairness, responsibility and accountability.

11:36 Posted in Luxembourg | Permalink | Comments (0)