03/16/2009

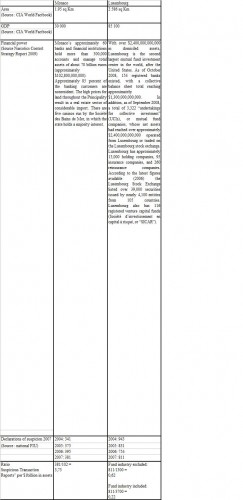

Declarations of suspicion : Luxembourg v. Monaco

The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry excluded, is 6 times less than Monaco

The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry included, is almost 17 times less than Monaco.

Some might have thought that my blog expresses some biased opinion, such as in this comment. Unfortunately they are fact. And they cannot fool the people behind the Narcotics Control Strategy report 2009, which observes that in Luxembourg the scarce number of financial crime cases is of concern, particularly for a country that has such a large financial sector.

There is a motto that is used by professionals in Luxembourg : They usually answer critics that what they criticize about Luxembourg ignores the law and the reality of the Luxembourg Financial Center. Comparing financial centers demonstrates that unfortunately Luxembourg is not at the level of the other jurisdictions.

I do believe that those who really support Luxembourg in the long term are not those who hush up issues or deny dysfunctions or even seem to justify them by calling upon the bad actions of others (sales of weapons...) True support comes from those who have a broad view and understanding of what is at stake in the world.

Who said five years ago: “We want to remain what we are. Yes, we want to remain what we are and for this reason, we must change to adapt and evolve. The world does not wait for us. And we should not wait for the world. We must go and meet it, otherwise it crushes us.”

Jean-Claude Juncker (Declaration of August 4th, 2004)

I am afraid he had bad advisors who ignore the laws and the realities of the world.

FIU Monaco report

FIU Luxembourg Report

CIA World Factbook

Narcotics Control Strategy report

19:34 Posted in Comparison | Permalink | Comments (0)

Interim report of the ALFI Madoff Task Force in Luxembourg

The ALFI has today published the Interim report of the ALFI Madoff Task Force in Luxembourg and technical guidelines for Fund of Funds concerning the valuation of investment Funds affected by Madoff.

The report states that Lxembourg legislation on fund depositaries faithfully reflects the provisions of European Council Directive 85/611/EEC (the UCITS Directive) and that Luxembourg has a suitable framework for a proper protection of investment fund assets and investors in line with European standards. The Luxembourg legal and regulatory environment is equivalent to that of the other major European jurisdictions.ynop

This statement does nor comply with the synoptic table of the UCTIS directive and the luxembourg legislation.

The reports states that the group wishes to issue practical industry guidance on the due skills, care and diligence (initial as well as ongoing) a depositary should apply when entering into a relationship with third parties. This means that the current texts are not clear enough or rather may create opportunities for drifts.

If I were the ALFI I would investigate WHO introduced Madoff in Luxembourg despite "red flags".

Report

Technical guidelines

19:17 Posted in Luxembourg | Permalink | Comments (0)

03/15/2009

Monaco to relax bank secrecy

Reuters has reported that Monaco will soon join moves to relax bank secrecy, following Belgium, Liechtenstein, Andorra, Switzerland, Austria, Luxembourg and others.

I will develop in the following days the situation in this jurisdiction that is smaller than Luxembourg, with a special responsibility for France.

Read IHT

19:25 Posted in Monaco | Permalink | Comments (0)