05/17/2009

Bad news for Luxembourg but good news for responsible financial actors

Richard Murphy has reported that Las Vegas Review wrote that President Barack Obama’s plan to limit tax breaks for multinational companies will include an amendment that affects alleged tax havens at home, including Nevada and Delaware, a knowledgeable source in Washington, D.C., said. The yet-to-be-announced amendment will make sure that U.S. states do not replace offshore countries like Switzerland, Luxembourg and the Cayman Islands as tax havens for wealthy individuals and businesses, the source explained.

As the existence of Delaware and Nevada was the only argument that Luxembourg politicians and officials found to avoid the handing-over in question, it is a new example of the bad approach of this jurisdiction that need homines novi (new leaders).

09:17 Posted in General | Permalink | Comments (0)

05/15/2009

Launch of the Luxembourg Institute For Global Financial Integrity: good initiative but questions remain…

The Luxembourg Institute for Global Financial Integrity announced its constitution yesterday. Founded by private citizens from Europe and The United States, under the auspices of Jacques Santer, former Prime Minister of Luxembourg and President of the European Commission, the institute is a nonprofit organization, that addresses the integrity of the global financial sector and the social responsibility practiced by all of its stakeholders.

According to Mr. Santer, "We recognized that the global financial sector is in need of stronger ethical practices and standards based on the principles of integrity: transparency, fairness, responsibility and accountability".

Jean-Claude Juncker, Prime Minister of Luxembourg, has given his personal endorsement and support to the institute in recognition of the need for a private, independent and impartial body that will group corporate, academic and non-governmental organizations, in Luxembourg and abroad who are engaged in the global financial sector, together to solve the challenges faced by the global financial sector pertaining to crime, such as fraud, tax evasion, and money laundering, and to the funding of criminal activity and terrorism.

The institute announced that in one of its first projects, Howard Gardner, Hobbs Professor of Cognition and Education of the Harvard Graduate School of Education, will advise and contribute to the institute in developing a financial sector ethics model that will serve as a reference framework and benchmark in the development of the ethical code of conduct of the global financial sector and the work that will later be carried out by the Institute.

As a newly created nonprofit organization, The Luxembourg Institute for Global Financial Integrity, is now enrolling members who will be active in all aspects of the institute. Banks, institutions and service providers in the global financial markets are being invited to join the institute. Research Fellows and Visiting Research Fellows are being sought out and brought on board. Collaboration is being established with universities, think-tanks and nongovernmental organizations (NGOs) engaged in social responsibility and transparency within the global financial sector.

The institute will initiate its first open dialogue within the global financial sector and with public and private institutions by organizing a Conference on "Ethics, bank secrecy and fiscal paradise" in Luxembourg on the 10th and 11th of December, 2009.

A couple of comments:

I definitely welcome the launch of such institute in Luxembourg, which meets two of my observations relating to the Luxembourg jurisdiction:

- As I demonstrated, business ethics was not taken into account in Corporate Social Responsibility as implemented in Luxembourg. The scope of the institute is consistent with the scope of the ORSE in the identification of issues and responsibilities specific to banks, insurance companies and asset managers. I understand that it is a special body for CSR in the financial sector. Better late than never.

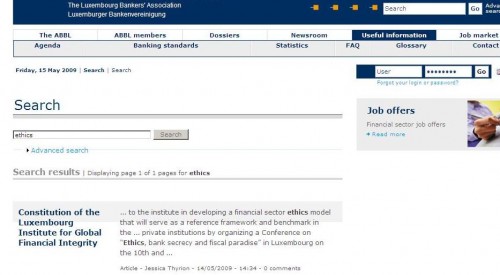

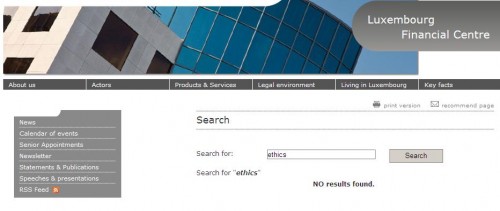

Ethics was not a concern for bankers in Luxembourg before the launch of the institute as there is only one result for the keyword: the one of the institute:

- As I explained, despite an international labor, Luxembourg was locked up in internal visions disconnected from realities from the world and lack thus of true pragmatism, pragmatism being a practical approach to problems and affairs ; otherwise they would have realised the paradigm shift mid 2000. The institute is open to the world.

Additionally, the sort and the wording of the scope is interesting: "to solve the challenges faced by the global financial sector pertaining to crime, such as fraud, tax evasion, and money laundering, and to the funding of criminal activity and terrorism" : AML-CFT come last as the current issue is fraud and tax evasion quoted firstly.

Nevertheless a couple of issues remain, of which:

Will the institute be a tool to change the business culture or is it an opportunist ethical frontage for the center? A clue to assess the credibility is the project team: is the project team relevant to promote stronger ethical practices and standards based on the principles of integrity: transparency, fairness, responsibility and accountability. Should there be team members involved in corruption issues or promotion of fraud or tax evasion or other dubious business behaviour (verifiable public lie to mislead the investors...), the institute would not be credible. Another clue will be the capacity to welcome "critics" especially when they lay emphasis on public and official dysfunctions that are the visible part of the iceberg. The word critic comes from the Greek κριτικός (kritikós), "able to discern", which in turn derives from the word κριτής (krités), meaning a person who offers reasoned judgment or analysis, value judgment, interpretation, or observation. In practice critics are blacklisted in the Luxembourg business.

How the institute will handle specific issues in Luxembourg due to the small size: conflicts of interest that can turn into corruption defined as an impairment of integrity, virtue, or moral principle? Luxembourg is a small jurisdiction where everybody knows everyone, where officials and ministers are reachable, etc.

How the institute will handle issues relating to businesses that do not belong to the financial sector but may cause a collateral damage for the reputation of the financial sector:

- Creation of scams connected to exotic jurisdictions on the OECD "grey list",

- Anybody can be a statutory auditor including exotic firms from the BVI, the Seychelles and so on, that are not controlled,

- etc.

In a nutshell, I am available to join the institute to which I want to give the credit at the beginning.

But as I am not a yes-man, as I have an independent mindset and as I have a true pragmatism based on facts, I don't think I will be welcome among the Research Fellows and Visiting Research Fellows that are sought.

17:30 Posted in Luxembourg | Permalink | Comments (0)

05/13/2009

Luxembourg still does not realise that its cheese moved

In a recent speech in Luxembourgish, Jeannot Krecké, who is Minister of the Economy and Foreign Trade in Luxembourg stated that « Mir musse vermëttelen, dass, och wa mir elo no OECD Standarden den Informatiounsaustausch praktizéieren, mir awer wëllen d’Bankgeheimnis heiheem weider bestoe lossen. Dëst ass jo och net dat eenzegt Argument fir eis Finanzplaz, op déi Lëtzebuerg sech och weiderhinn kann steepen” which means “We will implement the standards of OECD concerning the information exchange, but we want to maintain banking secrecy, on our premises. It is the only argument for our financial center, on which Luxembourg can continue to base itself”

The problem is that he (like every professional or politician in the jurisdiction) condones those who knowingly help to commit fraud through the Luxembourg financial center, and in a general rule, those who use professional secrecy to do what could be called obstruction to justice in some jurisdictions.

That is the reason why banking secrecy is no longer acceptable all the more than it is not a tradition in Luxembourg.

I find alarming that most leaders in Luxembourg can see banking secrecy as the “only argument” for the jurisdiction.

They should look for new cheese and ensure this new cheese is not corrupted by changing bad business habits that are emphasized because of the small size of the jurisdiction.

07:04 Posted in Luxembourg | Permalink | Comments (0)