10/29/2009

The richest you are in the financial sector the best LIGFI member you are

LIGFI just sent a press release that demonstrates once more it is a Luxembourg deceptive economic intelligence operation with no intelligence as it ignores facts in a jurisdiction that does not like critics.

A couple of sentences want commenting:

1. If LIGFI is engaged in recruiting members and partners within and outside the global financial sector, it calls for banks, other financial services and service providers to the financial sector to join the association

They are not calling for for academics, NGOs… It is definitely a body for the business in the financial sector, member outside the global financial sector being a frontage of opening.

2. Members will be called upon to financially support the LIGFI association through membership dues and/or grants

The fees are prohibitive and there is a dubious hierarchy by money that is not compatible with the spirit of ethics (See statutes).

The initial fee is fixed at:

- EUR 10,000 for charter members

- EUR 5,000 for public and private institutions

- EUR 2,500 for the financial sector and professional services

- EUR 1,250 for academe

The yearly fee is fixed at:

- EUR 2,000 for charter members

- EUR 1,000 for public and private institutions

- EUR 500 for the financial sector and professional services

- EUR 250 for Academe

Regular members assume the commitment to provide assistance and support to the a.s.b.l. and its activities. Any regular member has the ability to become a charter member. A charter member is a member recognized as committed at the highest level to the a.s.b.l., providing it with increased support and financial assistance (article 8 of the Statutes)

Charter members have eight voting rights each; public and private institutions have four voting rights each; financial sector and professional services have two voting rights each, and academe have one voting right each (article 28 of the Statutes)

3. Founded by private citizens from Europe and The United States

It is not accurate in the statutes, where founders and members of the board of regents are quoted:

- Jacques Santer, Luxembourger, Honorary Minister of State and former Prime Minister of Luxembourg, former President of the European Commission, residing in Luxembourg

- Michel Maquil, Luxembourger, President of the Luxembourg Stock Exchange, residing in Luxembourg

- Lucien Thiel, Luxembourger, Member of Parliament of Luxembourg and Honorary Director of the ABBL, residing in Luxembourg

- Patrick Zurstrassen, Belgian, Chairman of the Institut Luxembourgeois des Administrateurs, residing in Luxembourg

- Yves Wagner, Luxembourger, President of the Association des Analystes Financiers et Gestionnaires de Portefeuilles, residing in Luxembourg

- François Schanen, Luxembourger, Manager of the BCEE, residing in Luxembourg

- Gilbert McNeill, Swiss, Professor and Counselor, residing in the USA, residing in Luxembourg

- Luc Henzig, Luxembourger, Senior Partner of PricewaterhouseCoopers, Luxembourg, residing in Luxembourg

- Guy Harles, Luxembourger, Senior Partner of Arendt & Medenach, residing in Luxembourg

- Jed Grant, Irish, Senior Partner of Sandstone S.A, residing in Luxembourg

- René Brülhart, Swiss, Director of the Financial Intelligence Unit of the Principality of Liechtenstein, residing in Liechtenstein.

A private citizen is one who does not possess or exercise any authority or power of court, government, law enforcement, or military.

Lucien Thiel, Luxembourger, Member of Parliament of Luxembourg and Honorary Director of the ABBL, residing in Luxembourg is not a private citizen.

Furthermore founders are quoted with their job title and company. Most of them are acting in the Luxembourg financial sector directly or indirectly. They are acting as stakeholders of the Luxembourg financial sector.

Additionnaly members of the board of regents are definitely not "private citizens".

Jean-Claude Juncker, Honorary Chairman of the Board, is Prime Minister.

Lucien Thiel, Honorary Member, is member of parliament.

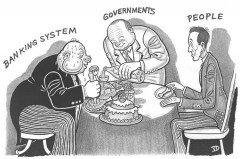

A brochure was published by the Luxembourg government in 1999 at a period where Jean-Claude Juncker was already Prime Minister. It states : "In Luxembourg direct contact with Cabinet members is a normal procedure. This produces quick and timely decisions. Avoiding over-regulation and excessive red tape has certainly prompted the emergence of Luxembourg as financial center in the nineteen sixties"

Professionals of the banking sector decide of policies.

Nothing has changed in the perfectible governance.

The day after the pre-announcement for the “Luxembourg Monthly Finance Lunch” a new ALFI brochure: " Your bridge between Europe and China: Luxembourg" was online

This brochures states page 2 : "Shape regulation. An up-to-date, innovative legal and fiscal environment is critical to defend and improve Luxembourg’s competitive position as a centre for the domiciliation, administration and distribution of investment funds. Strong relationships with regulatory authorities, the government and the legislative body enable ALFI to make an effective contribution to decision-making through relevant input for changes to the regulatory framework, implementation of European directives and regulation of new products or services."

17:39 Posted in Luxembourg | Permalink | Comments (0)

10/28/2009

Luxembourg Is Going to Fool the International Institutions

When the Luxembourg Institute for global Financial Integrity was launched in May, Richard Murphy was contacted by Gibb McNeil, its Executive Director (also board member and president of the executive committee).

Richard noted the extraordinary fees they propose charging which are way beyond most NGOs, let alone academics or others who might have interest.

LIGFI has officially announced (with a delay) the Luxembourg Monthly Finance Lunch that is held at the Cercle Munster, 5-7, rue Munster, L-2160 Luxembourg City. The event starts at 11:45 h with drinks, followed by lunch at 12:15 h. The event is concluded by 14:00 h.

The lunch fee of 50 € is to be paid at the Cercle Munster prior to the lunch.

The lunch fee is telling of what Richard observed 6 months ago and raises a couple of questions:

The lunch fee for LIGFI is 50 € whereas the lunch fee for AMCHAM for example is 40 €

Why is it so expansive ? Such fee is way beyond most NGOs, let alone academics or others who might have interest.

Will NGOs and academics be invited by banks and other financial institutions ? If yes, what about their independance?

The pre-announcement for the “Luxembourg Monthly Finance Lunch” was online on Wednesday, 21 October 2009.

The day after a new ALFI brochure: " Your bridge between Europe and China: Luxembourg" by ALFI whose members would be wealthy enough to invite NGOs and academics.

This brochures states page 2 : Shape regulation. An up-to-date, innovative legal and fiscal environment is critical to defend and improve Luxembourg’s competitive position as a centre for the domiciliation, administration and distribution of investment funds. Strong relationships with regulatory authorities, the government and the legislative body enable ALFI to make an effective contribution to decision-making through relevant input for changes to the regulatory framework, implementation of European directives and regulation of new products or services.

This sounds like a renewal of what Rafik Fischer said a couple of years ago that I have quoted several times.

What is the practical consequence?

Professionals confirm they decide of the regulatory framework : hence for example poor sanctions compared to what is done in other jurisdictions ; this is the reason why the crime pays in Luxembourg.

Professionals confirm they decide of the implementation of European directives : hence for example the changes to the UCITS directive that introduced the flexibility (the so-called

innovative legal and fiscal environment) that facilitated the drift with Madoff.

Professionals confirm they decide of regulation of new products or services.

In this context, regulation is a frontage in the jurisdiction. So is the recent talk on ethics through LIGFI.

QED.

Will FATF and OECD smell the coffee?

18:01 Posted in Luxembourg | Permalink | Comments (0)

10/27/2009

The Luxembourg Monthly Finance Lunch: A business view on ethics in policies

According to LIGFI website, the Luxembourg Institute for Global Financial Integrity is launching “the first cycle of the Luxembourg Monthly Finance Lunch. The purpose of the lunch is twofold: (1) providing the opportunity of hearing a personality of authority and international recognition present his opinion on current issues affecting the global financial center; and, (2) serving as a venue at which people can meet and engage in dialogue.

The lunch is open to all. LIGFI hopes to attract participants from Luxembourg, its neighboring countries and beyond.

The first Keynote Speaker at the lunch, set for Wednesday 25th of November 2009, will be Luxembourg Finance Minister Luc Frieden who will start off the lunch cycle on the theme 'A political view on ethics in business.'”

I am very happy to see that professionals and politicians in Luxembourg demonstrate once more their close link in the jurisdiction where professionals have a close and direct say in the drawing up of laws and regulations that are enforced and fustigate thos who dare question (see reactions after the publication of Rainer Falk's study).

As I said, we have three Luxembourg politicians in the Board of Regents, that belong to the same political party that leads the jurisdiction for years.

The first Keynote Speaker at the lunch, set for Wednesday 25th of November 2009, will be Luxembourg Finance Minister Luc Frieden, who belongs to the same political party that leads the jurisdiction for years.

I am afraid Minister Frieden failed to implement ethical provisions that were required when he was Minister of Justice whereas the jurisdiction communicates that one on its quick decision-making process (see for example PwC Luxembourg brochure: "Why Luxembourg", page 39, and page 93 of a brochure that was published by the Luxembourg government in 1999, the year when Luc Frieden was reappointed Minister of Justice: "In Luxembourg direct contact with Cabinet members is a normal procedure. This produces quick and timely decisions. Avoiding over-regulation and excessive red tape has certainly prompted the emergence of Luxembourg as financial center in the nineteen sixties") and that was able to change the constitution in a couple of weeks.

“What we all are missing are facts, rather than the continuous outflow of innuendos, unsubstantiated attacks and emotional outbreaks”, an article posted recently by LIGFI said.

Let’s see two examples that are not exhaustive of the so-called “quick decision-making process” in areas related to ethics in business.

Criminal liability for legal persons

Criminal liability for legal persons is required both by the OECD Anti-Bribery Convention, which was signed on 17 December 1997 and came into force on 15 February 1999, and by many OECD reports (and GRECO reports) in the 2000s.

Parliamentary question Number 466 dated 3 April 2000 (Xavier BETTEL and Gusty GRAAS) was about the criminal liability of legal persons. Luc Frieden’s answer was the following : “ J'ai l'honneur de vous confirmer que le Luxembourg va légiférer en vue d'introduire le principe de la responsabilité pénale des personnes morales. Le groupe de travail "Réforme du droit des sociétés" est chargé d'élaborer le concept. » (free translation : I have the honor of assuring you that Luxembourg will legislate in order to introduce the principle of the criminal liability for legal persons. The work group “Reforms of business law” is charged to work out the concept”.

I love the idea that criminal liability for legal persons is a “concept” i.e. something conceived in the mind or an abstract or generic idea generalized from particular instances.

The Luxembourg government has filed on 20 April 2007 Bill number 5718. There are only 22 pages.

What is the status?

Nothing enforced and OECD is getting nervous:

- "OECD urges Luxembourg to introduce liability of legal persons for foreign bribery" (OECD Working Group on Bribery, 27 March 2008)

- "Toutefois, force est de constater que plus de deux ans se sont écoulés depuis le dépôt du projet de loi, sans que celui-ci n’ait encore franchi une étape décisive dans la procédure parlementaire. Le Groupe de travail de l’OCDE sur la corruption reste donc sérieusement préoccupé par l’absence de responsabilité des personnes morales en droit luxembourgeois, dix ans après l’entrée en vigueur de la Convention sur la lutte contre la corruption d’agents publics étrangers dans les transactions commerciales internationales. Cette situation constitue un manquement grave et continu aux obligations du Luxembourg par rapport à la Convention." (Mark Pieth-OECD Working Group on Bribery, 22 July 2009)

Mutual Assistance in Criminal Matters between the Member States of the European Union

The Luxembourg government has filed on 20 March 2009 the Bill N°6017 bearing

1. Approval of the Council Act of … 29 May 2000 establishing in accordance with Article 34 of the Treaty on European Union the Convention on Mutual Assistance in Criminal Matters between the Member States of the European Union.

2. Approval of the Council Act of ... 16 October 2001 establishing, in accordance with Article 34 of the Treaty on European Union, the Protocol to the Convention on Mutual Assistance in Criminal Matters between the Member States of the European Union

3. Change to certain provisions of the criminal Instruction code and the law of 8 August 2000 on Mutual Assistance in Criminal Matters

There are only 22 pages.

What is the status?

Sent to the “legal committee” (Commission juridique) twice: 16 April and 8 October.

Nothing enforced.

I am exaggerating when I state that in Luxembourg business view is over ethics in policies?

Definitely not.

I will quote again what the first Keynote Speaker said before the Association Luxembourgeoise des Professionnels du Patrimoine (ALPP).

Before the Association Luxembourgeoise des Professionnels du Patrimoine (ALPP), Luc Frieden confirmed the objective to sign 20 OECD-compliant tax agreements by the end of the year. But the stated good intention is broken by the last sentence of the last but one paragraph that quote the professionals: “We rely on you. Our clients believe in us. They are there because of banking secrecy.”

Why on earth are clients there because of banking secrecy? For tax evasion all the more than there will be no automatic information exchange.

One understands better the reason why Luxembourg is not in favor of automatic exchange.

Can they rely on Minister Frieden?

Yes they can. The answer was given two years ago before the same Association Luxembourgeoise des Professionnels du Patrimoine (ALPP):

« Est-ce qu'une grande place financière comme la nôtre doit exagérer un peu ou bien être plus laxiste au risque de laisser passer quelques scandales ? Oui, il peut arriver que nous ayons exagéré certaines procédures, mais c'était dans une tendance générale en Europe. J'espère que nous n'avons pas mal fait et qu'il est encore possible de revenir en arrière. Je ne veux surtout pas que l'on dise que nous ne faisons plus rien et je suis prêt à abandonner certaines exigences » (free translation: "Should a large financial center like ours exaggerate or be more lax with the risk of a couple of scandals. Yes we may have exaggerated some procedures but this was a general trend in Europe. I hope we have not done badly aand that it is still possible to go back. I am ready to give up some requirements"), Luc Frieden said.

In this context, the "level playing field" concept that was stated a couple of days ago (the European Union is a zone where rules differ from those applied outside, but given the volatility of capital and the free circulation of capital, we must take care that these rules do not work to the detriment of financial centres within the European Union) to block an agreement with Liechtenstein sounds like foot-dragging tactics. If the issue is actual, Luxembourg should have asked for measures to control the flows outside the European Union. Luxembourg and Austria had actually a selfish attitude as banking secrecy and limited exchange (that was accepted under pressure) favor tax evasion that is not repudiated.

A business view on ethics in policies rather than a political view on ethics in business, for the first lunch.

Quod erat Demonstrandum.

Happy lunch !!!!!

.

05:37 Posted in Luxembourg | Permalink | Comments (0)