11/17/2009

CPI: Transparency International smells the coffee

Transparency International today published its CPI (Corruption Perception Index).

The press release admits that the CPI is perfectible:

Financial secrecy jurisdictions, linked to many countries that top the CPI, severely undermine efforts to tackle corruption and recover stolen assets. Corrupt money must not find safe haven. It is time to put an end to excuses,” said Labelle. “The OECD’s work in this area is welcome, but there must be more bilateral treaties on information exchange to fully end the secrecy regime. At the same time, companies must cease operating in renegade financial centres.

It was reported in september that Dr. Johann Graf Lambsdorff, creator of the Corruption Perceptions Index, would no longer publish the landmark corruption ranking, he had said in an email to the Transparency International network. Lambsdorff wrote: "It is you, the movement, that will have to start anew to educate TI-S to deliver an acceptable product."

Transparency Indernational smells the coffee with financial secrecy.

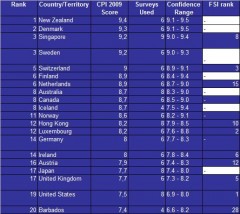

60% of the top 20 jurisdictions of the CPI are jurisdiction identified by TJN in the FSI (Financial Secrecy Index) table.

(Click to enlarge)

17:31 Posted in General | Permalink | Comments (0)

11/13/2009

White liste: the OECD charade is going on

Liechtenstein and Singapore have passed into the "OECD's whitewash, sorry, white list category" (TJN wording).

Liechtenstein scored an 87 percent opacity score and Singapore scored a 79 percent opacity score on TJN Mapping the Faultlines project.

Thanks to Luxembourg - the first jurisdiction that was congratulated - and its draft law to enforce the OECD agreements, everyone now knows that there is a huge loophole in the enforcement of the agreements: the creativity of jurisdiction to bypass agreements.

Luxembourg has imagined the "discharging fine", that would allow practically banks to keep secrecy and make money thanks to a possible new service that could be charged to clients.

12:19 Posted in General | Permalink | Comments (0)

11/08/2009

European Commission - captive to financial special interests?

TJN has commented a new report from ALTER-EU that addresses a wide range of concerns relating to the way Expert Groups dominated by large private banks, insurance giants and a range of financial enterprises wield significant power within the EU legislative process - from the drafting of EU strategies and laws to their implementation.

Paul de Clerck member of ALTER-EU's steering committee, said: "The Commission only seems to be interested in listening to the advice of the finance industry, rather than acting in the interests of society. Light touch regulation may have made it easier to do business, but it has not protected our savings and our pensions from being gambled away. Now the Commission tells us they are tightening the rules but in reality their proposals still leave many loopholes. If the Commission wants to restore confidence in our financial systems, it must break free of this stranglehold of partial advice."

I agree with him. What happened with Madoff in the European jurisdiction is the result of poor controls and will at the European level (see my Fault Tree Analysis).

Read the report09:44 Posted in General | Permalink | Comments (0)