07/03/2009

The base of funds is confidence, and the base of confidence is the truth

A couple of days ago I wrote an article to comment the last EFAMA report that is quite surprising in the way it handles the Madoff story in Europe.

I concluded that investors cannot rely on the EFAMA to tighten up the ship on the root causes of the Madoff fraud in Europe.

As I said in a press release issued from http://europa.eu late May, it was stated the following information:

Commissioner McCreevy initiates clarification of UCITS (Undertakings for Collective Investment in Transferable Securities) regulations regime. Commissioner McCreevy announced today in Brussels that he intends to clarify and strengthen provisions of the UCITs regime particularly as regards the liability of depositories. He announced he will launch a consultation before the end of June to deal with inconsistencies in the application of the UCITS directive which were shown by the Madoff scandal. One of the consequences of the Madoff scandal in the EU is that it affected retail investors who had invested in certain UCITS funds the assets of which had been entrusted to a Madoff entity as a sub-custodian. Last December (MEMO/09/27) Commissioner McCreevy informed Ministers of Finance that he had asked his services to work closely with the Committee of European Securities Regulators (CESR) to look into the liability of the UCITS depositories in the 27 Member States. The outcome of this review by CESR is now known and it shows that the minimum high level principles of the UCITS Directive have been transposed in very diverging ways by Member States. The outcome is an unlevel playing field. This means that some EU investors in UCITS funds are better protected than others. On the other hand, the Commission has made stringent proposals on the regulation of depositories, their liability, eligibility, etc in its recent proposal for Alternative Investment Fund Managers (AIFM) (MEMO/09/211). According to this proposal, depositories should be credit institutions based, authorised and supervised in the EU. Their liability has been strengthened, including an inversion of the burden of proof, and there are clear provisions on delegation as well as on the conditions under which assets can be entrusted to depositories outside the EU. Mr McCreevy wants to extend such provisions to UCITS funds. The new proposal should at least cover what the AIFM proposal covers. It would not be appropriate to have a less stringent approach for retail investors than for professional investors.

It is extraordinary that the funds business community boycotted more or less the information.

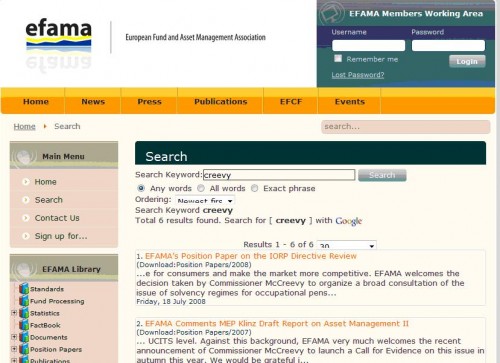

I looked at the EFAMA website, the ALFI website and the ABBL website.

There is nothing about McCreevy’s opinion on the EFAMA website:

Additionally I found an opinion from the EFAMA to the CESR that is worth reading:

It is stated that “From the industry’s perspective, the analysis of the implementation of the role and liabilities of depositaries in different Member State following the Madoff fraud, and the introduction of any new measures resulting thereof, are outside the scope of the present mandate. To be able to maintain its own timetable, CESR should clearly limit itself to giving advice on Articles 23 and 33 of the UCITS IV Directive”. (source: EFAMA Response to CESR Call for Evidence/UCITS Level 2, 31/03/2009, page 3)

There is a psychological denial of the issue of the depositary with no will to tighten up the ship on the role and liabilities of depositaries in different Member State following the Madoff fraud i.e. no will to establish the truth, which is that the lax implementation of the directive, the so called clear and pragmatic rules, created the risk in Luxembourg.

Nobody in the industry’s perspective is actually in favour of this truth.

The jurisdiction from which the drift took place has the same behaviour that it exported while using a corporate spirit at the European level.

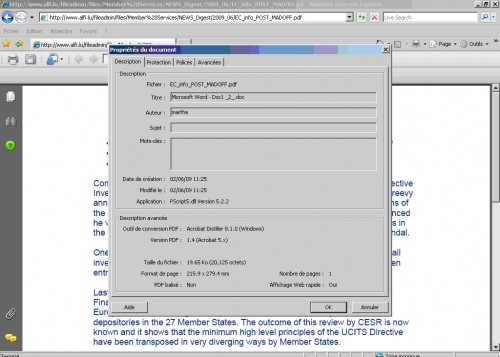

McCreevy’s opinion is quoted in the alfi news digest dated June 2009 in a minimizing way by not stating with accuracy the key findings:

It is stated page 5 out of 8 that “Commissioner McCreevy initiates clarification of UCITS (Undertakings for Collective Investment in Transferable Securities) regulations regime. The commissioner McCreevy announced that he intends to clarify and strengthen provisions of the UCITS regime particularly as regards the liability of depositories. He will launch a consultation before the end of June to deal with inconsistencies in the application of the UCITS directive. Please click here for more information.”

It is actually the beginning of the press release. The ALFI was unable to state notably that “the minimum high level principles of the UCITS Directive have been transposed in very diverging ways by Member States. The outcome is an unlevel playing field. This means that some EU investors in UCITS funds are better protected than others”. However there is a link to the full opinion.

The linked document was created on 2 June 2009

Why didn’t they quote this critical abstract?

An honest short communication should have been something like: Commissioner McCreevy initiates clarification of UCITS (Undertakings for Collective Investment in Transferable Securities) regulations regime as the minimum high level principles of the UCITS Directive have been transposed in very diverging (http://www.merriam-webster.com/dictionary/diverging) ways by Member States. The outcome is an unlevel playing field. This means that some EU investors in UCITS funds are better protected than others

The ABBL had published the information in a satisfying way a couple of days before and Luxembourg’s professionals of investment funds – by the way the first concerned - were definitely reluctant to publish about McCreevy’s opinion with accuracy.

Anyway there was no debate in Luxembourg about the issue and the debate is locked at the EFAMA level.

The above are facts that corroborate that the leaders of the European investment funds industry cannot be trusted by investors as the base of the investment funds industry is confidence, and the base of confidence is the truth.

What should have been done?

Luxembourg should have made amend and admitted at the beginning that the transposition opened the drift. A directive is a binding act of general application addressed to the Member States. Like a Community regulation or a decision, it is binding upon those to whom it is addressed. It is binding in its entirety and so may not be applied incompletely, selectively or partially. But a directive leaves to the national authorities the choice of form and methods. Because of its pragmatic lawyers and professionals, Luxembourg did not transpose with accuracy articles 7 and 10 of the directive, which is easily verifiable.

The Luxembourg fund industry should have demonstrated its great sense of responsibility:

- by compensating every investor (if the official amount of the fraud – less than EUR 2 billions - is actual, it was worth compensating because of the reputational stake),

- by correcting the legal and regulatory framework that opened the drift

Luxembourg and UBS should have negotiated for UBS to compensate partially the Luxembourg financial center as there is probably a sharing of wrongs.

17:30 Posted in General | Permalink | Comments (0)

The comments are closed.