06/01/2009

Pragmatism of deposit-guarantee schemes in Luxembourg

Directive 2009/14/EC of the European Parliament and of the Council was transposed in le Luxembourg legislation.

Luxembourg clear and pragmatic transposition of European directives is visible once more. Lucien Thiel was rapporteur of the law. He is one of the founders of the LIGFI.

The minimum coverage is not clearly increased as it appears that there is no budget to do so.

Additionally the wording of the transposition of one of the clauses of the directive is interesting.

The directive states that “1. Member States shall ensure that credit institutions make available to actual and intending depositors the information necessary for the identification of the deposit guarantee scheme of which the institution and its branches are members within the Community or any alternative arrangement provided for in the second subparagraph of Article 3(1) or in Article 3(4). The depositors shall be informed of the provisions of the deposit-guarantee scheme or any alternative arrangement applicable, including the amount and scope of the cover offered by the deposit-guarantee scheme. When a deposit is not guaranteed by a deposit-guarantee scheme in accordance with Article 7(2), the credit institution shall inform the depositor accordingly. All information shall be made available in a readily comprehensible manner.

Information about the conditions for compensation and the formalities which must be completed to obtain compensation shall be given on request”

The Luxembourg law states that « (1) Les établissements de crédit de droit luxembourgeois, leurs succursales établies dans d’autres Etats membres et les succursales luxembourgeoises d’établissements de crédit ayant leur siège social dans un pays tiers fournissent aux déposants effectifs et potentiels des informations relatives au système de garantie des dépôts dont ils sont membres ou relatives à un autre mécanisme prévu à l’article 62-5, paragraphe (4). Les déposants sont pour le moins informés sur le montant et l’étendue de la couverture offerte par le système de garantie ou le cas échéant par un autre mécanisme. Des informations relatives aux conditions d’indemnisation et les formalités à remplir pour être indemnisés sont fournies aux déposants effectifs et potentiels sur simple demande »

Free translation : “The credit institutions under Luxembourg Law, their branches established in other Member States and the Luxembourg branches of credit institutions having their head office in a third country provide to the effective and potential depositors information relating to the guarantee scheme of the deposits of which they are members or relative to another mechanism envisaged in article 62-5, paragraph (4). The depositors are at the very least informed on the amount and scope of the cover offered by the deposit-guarantee scheme or if necessary by another mechanism. Information about the conditions for compensation and the formalities which must be completed to obtain compensation shall be given to actual and intending depositors on request”

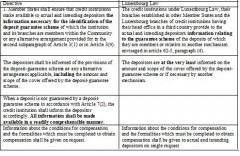

Synoptic table :

The wording of the directive is changed, which opens the drift for a misleading communication:

- If the directive requires to provide “to actual and intending depositors the information necessary for the identification of the deposit guarantee scheme ”, the Luxembourg text states " to actual and intending depositors information relating to the guarantee scheme". The wording of the requirements is vague: "the information necessary" v. "information relating"

- If the directive requires that “depositors shall be informed of the provisions of the deposit-guarantee scheme or any alternative arrangement applicable, including the amount and scope of the cover offered by the deposit-guarantee scheme” the Luxembourg law only requires "at the very least" the amount and scope of the cover offered : the impact is not the same. Information that must be provided is larger in the directive.

- The provision of the directive “When a deposit is not guaranteed by a deposit-guarantee scheme in accordance with Article 7(2), the credit institution shall inform the depositor accordingly. All information shall be made available in a readily comprehensible manner” is not in the Luxembourg text.

These are facts of a misleading information that will be provided knowingly to the investor on deposit-guarantee schemes in Luxembourg: I am afraid the transposition does not comply with the principles of integrity, as stated by Jacques Santer for the launch of the LIGFI: transparency, fairness, responsibility and accountability in the financial sector.

This reminds me of the pragmatic transposition of the UCITS directive that opened the drift with Madoff, which is denied but definitely proven with a synoptic table.

18:51 Posted in Luxembourg | Permalink | Comments (1)

Comments

Merci pour ce tres bon billet. Le sujet me passionne aussi et je doit admettre que le votre est une reference.

A bientot.

Posted by: gagner de l argent sur internet | 05/19/2013

The comments are closed.