02/08/2009

Latest Recast of the Directive 85/611/EEC: missing provisions in the Luxembourg law still required

The lastest proposed changes to the UCITS Directive dated July 2008 are intended to remove administrative barriers to the cross-border distribution of UCITS funds, create a framework for mergers between UCITS funds, allow the use of master-feeder structures, replace the Simplified Prospectus by a new concept of Key Investor Information and improve cooperation mechanisms between national supervisors.

I have pointed out two provisions of the Directive that was issued in 2005 that are missing in the Luxembourg law of transposition.

The question is: are these provisions still required after the changes to the UCITS framework?

The answer is definitely yes even though the number of the articles and the wording was changed.

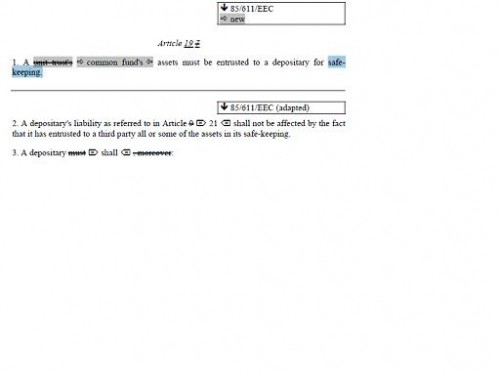

Article 7 is now article 19 with the following first paragraph: “1. A common fund's assets must be entrusted to a depositary for safekeeping”

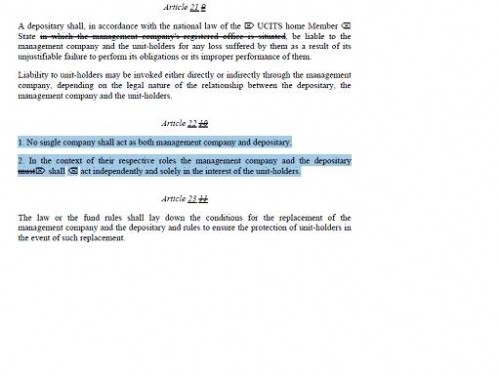

Article 10 is now article 22 with the following text: “1. No single company shall act as both management company and depositary. 2. In the context of their respective roles the management company and the depositary shall act independently and solely in the interest of the unit-holders.”

“Must act independently” was replaced by “shall act independently” for the second paragraph.

When officials in the Luxembourg jurisdiction dare to state that the Luxembourg law complies with the European Directive like the ALFI before the EFAMA: “Minister Luc Frieden and then Prime Minister Jean-Claude Juncker unequivocally stated that Luxembourg has faithfully transposed the UCITS Directive", it is definitely a stupid lie as very easy to check and politicians and professionals of the ALFI in the jurisdiction are no longer trustable.

This is true as well for AML provisions, anti bribery provisions… The Pandora box is opened.

When one does not tell the truth on something easy to check, he/she is no longer trustable and reliable in the business.

It is definitely worrying for the financial community worldwide whose success is based on confidence and that cannot support anymore a weak link.

That is the reason why I sent yesterday the following e-mail to Commissioner McCreevy:

Dear Mr Mc Creevy

The Luxembourg authorities state that the Luxembourg law to transpose the UCITS directive complies with the UCITS Directive.

I am afraid leaders of the financial center of Luxembourg are not telling the truth, which is all the more unacceptable than it is easy to check by building a synoptic table I have attached.

There are actually two critical provisions that are missing in the Luxembourg text but that can be found in the Irish text.

1)

Article 7 of the UCITS directive states that “1. A unit trust's assets must be entrusted to a depositary for safekeeping”. The word “safekeeping” was removed in the transposition (Cf. article 17 of the Luxembourg Law of 20 ecember 2002). Additionally, Circular IMS 91/75 (as amended by Circular CSSF 05/177) dated 21 January 1991 states that “The concept of custody used to describe the general mission of the depositary should be understood not in the sense of “safekeeping”, but in the sense of “supervision” (…) The depositary has discharged its duty of supervision when it is satisfied from the outset and during the whole of the duration of the contract that the third parties with which the assets of the UCI are on deposit are reputable and competent and have sufficient financial resources.“

2)

Article 10 of the UCIT directive states that “ 1. No single company shall act as both management company and depositary”. Such provision is not in the Luxembourg text. This first paragraph was removed to only transpose literally paragraph 2 that states that “2. In the context of their respective roles the management company and the depositary must act independently and solely in the interest of the unit-holders.” (Cf. article 20 of the Luxembourg law of 20 December 2002)

What is not prohibited by the law is possible and it seems that UBS acted both as Management Company and depositary.

ALFI’s views on the Madoff affair and its implications for the Luxembourg fund industry that was presented at the EFAMA Management Committee meeting held on Tuesday, 20 January was therefore a misleading communication. So is a misleading communication what stated the governmental authorities about the legal and regulatory framework of the jurisdiction.

In a nutshell, time is up for the Commission to smell the coffee and realise that by its feeling of impunity and of being above the law (they are not telling the truth publicly on things easy to verify), Luxembourg threatens the credibility of the ethical policies.

Best regards.

Jérôme Turquey

Consultant in Business Ethics and Reputational Risk

http://ethiquedesplaces.blogspirit.com

I am looking forward to reading his answer. If I get one as I do consider that the European Commission did not do its job and has a liability in the situation.

By the way, who chairs the Eurogroup?

11:00 Posted in General | Permalink | Comments (1)

Comments

Bonjour

je viens de lire un article sur PWC et son éthique, je souris ...jaune.

La juriste PWC a conseillé à mon boss pour virer vite :l'abandon de poste ( mon boss n avait pas de véritables raisons) cette juriste a suggéré l'abandon de poste comme solution de facilité!J'ai même la lettre écrite de cette juriste logo PWC en bas de lettre etc..., et au cas où je refusais cette sympathique solution ( être trois jours absent du bureau), un brouillon de transaction était déjà prêt!

Je ne suis que le troisième employé à devoir partir de cette petite boite dont PWC joue les RH

quelle éthique!!

Posted by: Luisgil | 02/14/2009

The comments are closed.