07/31/2009

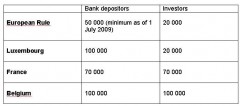

Depositor & Investor Compensation Schemes: Luxembourg v. France v. Belgium

Figures (in EUR)

As far as investors are concerned, the Directive sets a Community minimum level of compensation per investor of Euro 20 000, while at the same time authorising Member States to provide for a higher level of compensation if they so wish. However, certain categories of investors may be excluded by Member States from the scheme's coverage or may be afforded a lower level of coverage. The arrangements for organizing and financing schemes are left to the discretion of Member States.

Clever investors will realize they seem less protected in Luxembourg than in France or Belgium, that both go beyond the directive.

Source:

07:38 Posted in Comparison | Permalink | Comments (0)

07/30/2009

Relevant questions

"Aujourd'hui la plupart des pays disposent de textes anti-blanchiment et le blanchiment n'a pas disparu. Ce qui compte c'est la mise en œuvre: quel poids a la personne chargée des vérifications au sein d'un établissement financier, peut--elle imposer ses vues, de quels moyens dispose-t--elle ?" (Thierry Godefroy, CNRS)

(free translation: “Today most jurisdictions have AML texts, and money laundering did not disappear. What counts it is the implementation: which power has the person in charge of the controls within any financial institution, can he or she to impose his or her views, what are his or her means?”

Source : Les Echos

13:15 Posted in General | Permalink | Comments (0)

Swiss authorities investigate bribery accusation in UBS tax case

Reuters has reported that Swiss prosecutors said on Wednesday they are investigating allegations that an unnamed high-ranking Swiss official took a bribe from a U.S. client of UBS to help cover up tax fraud.

Federal prosecutors said in a statement the tax authority had filed charges against unknown persons which it was now investigating, without giving further details.

A U.S. client of the Swiss bank, which is at the centre of a U.S. tax fraud case, pleaded guilty on Tuesday to using Swiss bank accounts to hide money from the U.S. taxman and said he paid a Swiss official $45,000 to help cover up the fraud.

UBS is more and more disappointing. They had a video on Corporate Social responsibility, with the participation of Jermyn Brooks, Director Transparency International. It is no longer online but I have it as it is a very good example of the deceptive use of Corporate Social Responsibility for the good image while not respecting rules all the more than there are links between money laundering, tax evasion and financial regulation.

What Jermyn Brooks said is quoted in a brochure : “UBS was instrumental in creating the Wolfsberg Group, named after their own management training center in Switzerland. With the help of the anti-corruption organization, Transparency International, 12 of the worlds largest banks – banks which would normally be guarded about sharing internal procedures with their competitors, collaborated to develop and publish the “Anti Money Laundering Principles” called the “Wolfsberg Principles” …which have received worldwide recognition as good practice – filling gaps in national laws and regulations.”

06:54 Posted in Switzerland | Permalink | Comments (0)