07/24/2012

Act local, be global, remain what we are

Luxembourg currently faces many issues that should definitely have been avoided if advice like mine were taken into account in time.

They thought that they had found THE solution, with LIGFI.

I expressed three years ago on this blog my doubts about LIGFI.

It is interesting to perform a review of the last months.

Ligfi was remamed Tigfi with the Motto: "Act local be Global".

Ligfi mission is stated on the website “The role of The Institute for Global Financial Integrity (TIGFI), as a private, independent and impartial nonprofit organization, is to serve as a Center of Excellence and Forum on all matters pertaining to ethical conduct and integrity in business standards and practices in the global financial sector, national financial centers and jurisdictions. The core purpose of TIGFI is to support and promote professional excellence and ethical business standards and practices from within the global financial sector, national financial centers and jurisdictions. Its activities fall within the realm of corporate social responsibility and of environmental, social and governance (ESG) issues."

With so an impressive mission statement one would expect that this so called "Center of Excellence and Forum on all matters pertaining to ethical conduct and integrity in business standards" would discuss issues taking place in Luxembourg and abroad.

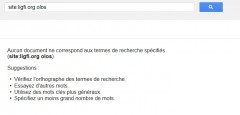

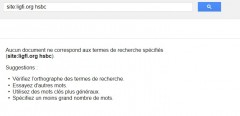

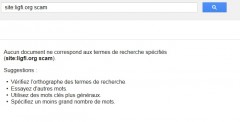

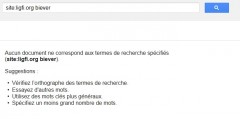

A Google search on LIGFI/TIGFI website with a couple of keyword shows to what extend TIGFI is actually a Forum on all matters pertaining to ethical conduct and integrity in business standards with its highly qualified and outstanding research professionals from industry and academe.

Madoff

I posted many articles, especially one to call LIGFI to do the job as my report to the European Commission demonstrates the reason why the Madoff fraud took place in Luxembourg

Why TIGFI highly qualified and outstanding research professionals from industry and academe did not contribute about that?

Olos

I knew neither Mr Becca nor Mr Finck but the Corporate Regisration was telling enough to raise conflict of interest and lax situations in the Corporate Registration for the least (See my previous articles about Luxembourg).

Why TIGFI highly qualified and outstanding research professionals from industry and academe did not contribute about that?

Hsbc files

German prosecutors targeted suspected tax cheats using data stolen from HSBC in Luxembourg, according to German media reports(See article 1 and 2 about the issue).

Why TIGFI highly qualified and outstanding research professionals from industry and academe did not contribute about that?

Scams

Belgian tax admin reported that scams were created in Luxembourg (See article 1 and 2)

Scams were created in Luxembourg to bypass the OECD convention on bribery and finance elections (See article 1 and 2). Neither Heine nore Eurolux are quoted on the website.

Luxembourg police did a very good job to tighten up the ship but nobody acted to prevent such scams.

Why TIGFI highly qualified and outstanding research professionals from industry and academe did not contribute about about that?

Prosecutor Biever's statement

General prosecutor Biever observed that there are “too little resources for financial files” and a “Lack of political will to fight financial crime” (See article 1 and 2)

Why TIGFI highly qualified and outstanding research professionals from industry and academe did not contribute about that?

Libor scandal

Libor scandal is a recent issue that took place in the UK with consequences worldwide.

Why TIGFI highly qualified and outstanding research professionals from industry and academe did not contribute about that?

The exemples are not exhaustive.

The fact that the above issues are still under investigation is not a relevant explanation to hush up the debate.

FATF Report

As far as AML is concerned what about FATF report on the website? There are results that are consistent neither with the communication of center nor the facts.

What was the communication before the report?

FATF issued a report that was very negative.

I thought everything was fine. TIGFI highly qualified and outstanding research professionals from industry and academe had said that. I was unable to find any TIGFI opinion about this FATF report when it was published.

Luxembourg enacted legislation in a hurry to be compliant again.

However, "It is one thing to enact laws, and another to enforce them" (Angel Gurría, OECD Secretary-General).

International organisations perform a control that is a charade : It was said in 2004 that "Luxembourg is broadly compliant with almost all of the FATF Recommendations." and the jurisdiction communicated about that so called compliance.

Minister Biltgen wondered before the LIGFI audience that “The question remains, why is there such a gap between reality and the public perception of Luxembourg as a shady financial centre? “ (Quoted by LFF, 13 September 2011)

I guess everyone in the audience clapped like LFF that kills the messenger.

The first who tells the truth shall be executed

TIGFI contributions including in the framework of costly lunches at Cercle Munster are actually interesting but theorical as they are not based on what is going on: they are not pragmatic enough as they deny reality by hushing up issues and not stating concrete problems that are visible in public and official sources.

See for example what Jean Guill, who chairs CSSF, said. I will pick up his last sentence: “You are never completely certain that there cannot be fraud. You can’t regulate it away.”

I do not agree with him. You can control most fraud in Luxembourg as they are due to conflicts of interests and lax business behavior visible in the Corporate Registration that are denied by the regulator (not any word in Guill’s paper)

What is TIGFI motto?

Act local… Surely

Be global. Possibly

Remain what we are… De-fi-ni-te-ly

Let’s read again what I said in FT a couple of years ago: “The [financial centre of Luxembourg] wants to brush up its governance. If it doesn’t do that in the next few months, the centre will collapse.” He predicts, if the regulatory situation is not sorted out, dissatisfied investors and asset managers will move their business elsewhere.”

I am afraid that TIGFI highly qualified and outstanding research professionals from industry and academe are tired and should retire…

06:18 Posted in Luxembourg | Permalink | Comments (0)

07/23/2012

Switzerland: Money laundering tax at 40% and tax amnesty for all

It was reported that Germany, the United Kingdom and Austria, are about to ratify the agreement signed with Switzerland to impose a one-time tax in all deposits of citizens with tax base in such country with accounts on Swiss banks.

As the Institute for Professional Studies INC observes , "this arrangement generates questions. What kind of credible guarantees will the Swiss provide the money-receiving governments that they will get the entire amount of the 40% withhold tax on their citizens? Indeed, since no names will be given, such a guarantee cannot practically exist. And how to trust the Swiss government when the British government was responsible for fixing LIBOR for years affecting trillions of transactions all over the world? Furthermore what guarantees will be provided to bank clients that what ever will be left in their account after the cuts will be considered legitimate in their own country and how this legitimacy will be proved? By a Swiss bank statement? And, if the money laundering tax amounts to 40% why all or some of the 27 Member States do not grant their own Tax Amnesty directly with a minimum tax, ie 10% or 20% on repatriated capital hidden in Switzerland or elsewhere?"

Very relevant questions...

07:55 Posted in Switzerland | Permalink | Comments (0)

07/21/2012

Libor scandal

As BBC explains "Libor is the the inter-bank lending rate set every day by the British Bankers' Association (BBA). Libor sets the price for trillions of pounds of hugely valuable derivatives deals in the City - complex trades designed to, for example, insure banks against risk or allow them to make a bet on the future value of assets. it is also the benchmark for pricing some UK residential mortgages, more commonly for commercial mortgages, and increasingly for pricing commercial loans by banks to UK businesses. So, any successful manipulation of Libor would have affected more than just a few money brokers in the City"

Regulators from around the world are probing alleged manipulation by big US and European banks of the London interbank offered rate and other key benchmark lending rates.

18:59 Posted in UK | Permalink | Comments (0)