03/18/2009

The less you contribute to OECD budget the more influence you have on the policies

The Tagesanzeiger has reported that OECD Secretary-General Angel Gurría provided a new list, on which financial centres with banking secrecy, such as Switzerland, Luxembourg and Austria, are optically separate from the tax havens.

According to the OECD, tax havens would be:

Andorra

Anguilla

Antigua and Barbuda

Aruba

Bahrain

Belize

Bermuda

BVI

Cayman Iceland

Cook Iceland

Dominica

Gibraltar

Grenada

Guernsey

Jersey

Liberia

Liechtenstein

Marshal Islands

Monaco

Montserrat

Nauru

Netherlands Antilles

Niue

Panama

Saint Lucia

Saint of cement and Nevis

Saint Vincent and Grenadinen

Samoa

San Marino

The Bahamas

Turks and Caicos Islands

Vanuatu

According to the OECD, Financial centers would be:

Austria

Belgium

Brunei

Chile

Costa Rica

Guatemala

Hong Kong, China

Luxembourg

Macao, China

Malaysia (lab SCN)

Singapore

Switzerland

The Philippines

Uruguay

The idea of splitting meets my idea of black list and grey list, but the way it was done raises a question of governance at the OECD:

As the Tagesanzeiger explained, the splitting was made under the pressure of representatives from Switzerland, Luxembourg and Austria that only said they will cooperate : but there a difference between announcements and actual implementation of the commitments.

This means that the three jurisdictions that represent less than 3% of the OECD budget would decide of the standards and policies of the OECD regarding harmful tax practices and other connected matters (corruption, or money laundering in the framework of the FATF that has the same contribution shares as the OECD).

There respective Contribution share in percentage is the following:

Switzerland: 1.5

Austria: 1.146

Luxembourg: 0.216

Total: 2.862 % of the OECD budget.

When looking carefully the lists, it appears that

- every OECD member is in the good list ; in other word no OECD member is a tax haven.

- there are many inconsistencies in the List: what about the Seychelles, Delaware... for the tax havens list? What about the City... for the financial centers list?

07:12 Posted in General | Permalink | Comments (1)

03/17/2009

The OECD List of jurisdictions which have made insufficient progress in the implementation of international tax standards

The Tagesanzeiger has published a fragment of the OECD of jurisdictions which have made insufficient progress in the implementation of international tax standards at 5 March 2009.

Many jurisdictions said last week they were to relax their banking secrecy.

But

- banking secrecy is only one criterion,

- and these jurisdictions cannot be trusted on press releases.

To be definitely removed from a list (grey or black with a strict monitoring and an update of lists regularly) they have to demonstrate that they actually complies with international tax standards.

The difference between enacting and enforcing/implementing.

Read

06:57 Posted in General | Permalink | Comments (0)

03/16/2009

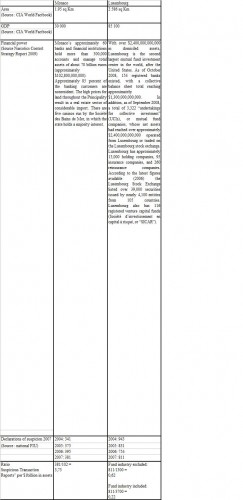

Declarations of suspicion : Luxembourg v. Monaco

The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry excluded, is 6 times less than Monaco

The ratio of Suspicious Transaction Reports per $1billion in assets for Luxembourg, fund industry included, is almost 17 times less than Monaco.

Some might have thought that my blog expresses some biased opinion, such as in this comment. Unfortunately they are fact. And they cannot fool the people behind the Narcotics Control Strategy report 2009, which observes that in Luxembourg the scarce number of financial crime cases is of concern, particularly for a country that has such a large financial sector.

There is a motto that is used by professionals in Luxembourg : They usually answer critics that what they criticize about Luxembourg ignores the law and the reality of the Luxembourg Financial Center. Comparing financial centers demonstrates that unfortunately Luxembourg is not at the level of the other jurisdictions.

I do believe that those who really support Luxembourg in the long term are not those who hush up issues or deny dysfunctions or even seem to justify them by calling upon the bad actions of others (sales of weapons...) True support comes from those who have a broad view and understanding of what is at stake in the world.

Who said five years ago: “We want to remain what we are. Yes, we want to remain what we are and for this reason, we must change to adapt and evolve. The world does not wait for us. And we should not wait for the world. We must go and meet it, otherwise it crushes us.”

Jean-Claude Juncker (Declaration of August 4th, 2004)

I am afraid he had bad advisors who ignore the laws and the realities of the world.

FIU Monaco report

FIU Luxembourg Report

CIA World Factbook

Narcotics Control Strategy report

19:34 Posted in Comparison | Permalink | Comments (0)