05/27/2009

Jean Asselborn admits the European Union was expected to provide solidarity (read impunity) about taxes.

Jean Asselborn was interviewed by RSR in Switzerland about Luxembourg tax policy.

What he said confirms that Luxembourg did rely on the European Union to provide solidarity (read impunity).

« L’UE c'est une communauté solidaire. »

Free translation: "The EU, it is a community where there is solidarity."

« Cette inscription, vous savez, sur la liste noire qui est devenue grise, ce n'était pas accordé au Conseil européen, ce n'était pas l'engagement du Conseil européen. Ça va à l'encontre de ce qui a été décidé »

Free translation: "This inscription, you know, about the black list which became grey, it was not granted at the European Council, it was not the commitment of the European Council. That goes against what was decided"

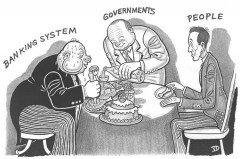

The relevant question is: is tax competition fair within the European Union?

According to many politicians and professionals in the European secrecy jurisdictions, and especially Luxembourg that is locked up in its certainty, it is because taxes are too high in France and Germany that taxpayers look for another jurisdiction.

Let’s admit they are right. What should be done to change that?

I have already observed that our European secrecy jurisdictions do not contribute a lot to the OECD budget despite a much more favourable GNP/GDP than in France and Germany.

What about the European Union figures?

The budget of the EU is a “gas factory”, but some ratios are interesting.

In 1970, the Luxembourg National contribution amounted to 0,1533% (6 / 3913*100) of the six countries. In 2007 it amounted to 0.2% (198 / 93414*100) of the 27 members while the jurisdiction has the highest GDP per capita

All figures for the calculation are available there: (The Excel Table is there)

It is easier for Luxembourg to have low taxes than for other jurisdictions and especially France and Germany all the more than Luxembourg does not have all the infrastructures that are needed in a larger state and that it profited from those (for example Universities in France and Germany: the fee for students, either national or foreign, does not cover all the direct or indirect functioning expenses that are financed by the taxpayer: buildings, scientific material, transportation…).

Example: the fee for a student is EUR 169 (year 2008-2009: http://www.nouvelleuniversite.gouv.fr/droits-d-inscription-pour-la-rentree-universitaire-2008.html). The cost of a student is around EUR 7000.

Who pay for the difference?

One can extend the benefit to research.

For example, if Luxembourg contributed to the implementation of the TGV (Train à Grande Vitesse, French for "high-speed train") between Luxembourg and Paris, I don’t think it contributed when it was developed during the 1970s by GEC-Alsthom (now Alstom) and SNCF.

In a nutshell, other criteria should definitely be sought to ensure a more balanced contribution of member states, taking into account the GDP per capita and expanses for the benefit of citizens of other states that do not have to pay for them (especially research and infrastructures).

And I bet Luxembourg will no longer be qualified as a tax haven as it would have to increase its taxes to pay for such more pragmatic European contribution…

06:19 Posted in Luxembourg | Permalink | Comments (0)

05/26/2009

LIGFI : the genesis

I have commented the launch of the LIGFI in Luxembourg and the non relevance of most members in the project team, under patronage of Jacques Santer who recently said that “Le Luxembourg n’a jamais ménagé ses efforts pour assurer la transparence voulue par l’Organisation de coopération et de développement économiques, et ceci en collaboration étroite avec le Groupe d’action financière (Gafi) instauré par l’OCDE justement. J’ajoute que le Luxembourg applique également les directives européennes, en matière de blanchiment d’argent notamment (free translation : Luxembourg never spared its efforts to ensure the transparency required by OECD, and this in close cooperation with FATF, founded by OECD precisely. I add that Luxembourg also implements the European directives, as regards money laundering in particular).

What about the OECD and GRECO requirements regarding the fight against corruption?

What about the enforcement of criminal liability of legal persons as requested by the OECD?

What about the poor means of the regulator compared to what exists abroad, which was admitted by the director who retired recently?

What about the scarce number of financial crime cases for a country that has such a large financial sector, which is regularly observed by the US Department of State in its International Narcotics Control Strategy Reports (INCSR)

Etc.

I am afraid he as a distorted view of reality, what is not good omen for an efficient and credible patronage.

As far as the association is concerned, there is an amazing discrepancy in the Corporate Registration.

It is said that “In the year two thousand and nine, on the twentieth of April (20 April 2009).

Between the undersigned (…) and all those who become parties to the present contract, is formed a non-profit organization in conformity with the law of 21 April 1928 on non-profit organizations and foundations, as amended. »

The Launch is dated 20 April 2009.

But, it is said infra that “The start-up funding of the a.s.b.l. by Sandstone S.A. for the period of September 2008 through April 2009 is allocated for Sandstone SA as a Charter Member to the maximum Charter member initial fee of EUR 40,000, with the amount outstanding to be charged against current and future annual fees as fixed by the Board of Directors”

This raises a couple of questions:

What/who is Sandstone S.A.?

Sandstone was founded in 2008 by a group of former intelligence and international security experts. Their mission is to provide the clients with high value commercial intelligence services.

What on earth was needed to be financed for the period of September 2008 through April 2009 for an association that was launched in April 2009 ?

The domain ligfi.org was actually registered in December 2008 by Jed Grant for Sandstone s.a.

LIGFI was in the pipe late 2008 but LIGFI was not developed until the April 2009 as the website is currently an empty shell (many blank pages)

The Hostmaster is ONEANDONE. Its fees are not very expensive.

The registered office and address are established at 5-7, rue Munster, L-2160 Luxembourg City, Grand Duchy of Luxembourg at the Cercle Munster. Admission to this club is reserved exclusively for members and their guests. To become a member of the club, a candidate's application must have the backing of two sponsors. The final decision rests with the admissions committee for admission.

Cercle Munster is a private business club with restaurants, shops… for wealthy people living in Luxembourg.

To reach the EUR 40,000 between September 2008 and April 2009, made deduction of the fees for the Hostmaster, this represents noshes-up at the Cercle Munster for the team.

Unless it was used at the time of the debate prior to the G 20 for economic intelligence actions (this is by the way Sandstone's business)and lobbying to promote the Luxembourg vision of business ethics.

18:40 Posted in Luxembourg | Permalink | Comments (0)

05/24/2009

Towards Anti Tax Evasion (ATE) standards

As I explained the OECD framework to counter tax evasion is not relevant and jurisdictions that are used for tax evasion do not want the review of the criteria.

It is a general principle that citizens pay the taxes where they live to contribute to the financing to the public policies and in international law there are assistance rules, which implies in tax matters communication of data relating to foreign citizens.

The protection of private life is limited to the actual residents of a given jurisdiction: in other words, banking secrecy to protect private life is fine for Luxembourg (or Swiss or any other) residents living in Luxembourg (or Switzerland or any jurisdiction for its residents), but it is not opposable to the tax administration of foreign citizens living in their country.

Banking secrecy is actually a tool for tax evasion as in most cases queries from foreign tax administration will not be satisfied despite the OECD tax model that requires accurate queries.

That is the reason why some people advocate for the automatic exchange.

There is a pragmatic way to fix the issue: there are international standards against AML-CFT that are taken into account in the procedures and codes of conduct of firms, and especially KYC. Why not enacting and enforcing Anti Tax Evasion (ATE) standards with a criminal liability for bankers help help to commit evasion?

There is no need for an international agreement at the OECD for that purpose.

Even though the enforcement of AML-CFT laws and regulations is dubious in some jurisdictions (for example in Luxembourg, according to the US Department of State, the scarce number of financial criminal cases is of concern, particularly for a country that has such a large financial sector: but it is true that, according to the Luxembourg FIU, 60% of banks never report any suspicious transaction. There are as well little declarations of suspicion from auditors whose commercial relationship with their auditees is emphasized and personalized by the small size of the jurisdiction… This would be evidence of the good faith of politicians and professionals, when they state their jurisdiction is no a tax haven and that banking secrecy has nothing to do with tax evasion.

14:51 Posted in Luxembourg | Permalink | Comments (0)